Several trends in the United States related to home ownership are developing that I find rather startling. Some of those trends have been slow, taking decades to mature, and perhaps have been noticed by many. Other trends are more acute temporally, springing up only over the past few years. These trends have altered the landscape of home ownership, and overall have made home ownership and housing security far more difficult for most Americans.

One of the first pieces of data I came across that struck me as significant was a 2018 chart showing that across the United States, the length of time needed to save for a 20% down payment on a home has increased by 1.5 years over the past 30 years. In 1988, with an average household income of $28,100, it took 5.7 years of savings to have 20% to place on the average home. In 2018, it was 7.2 years, with some more expensive cities outpacing this rate by several times.[1] Some studies show an even more extended amount of time needed to save for a down payment, reporting a more than ten-year average, compared to 6.4 years in 1971.[2]

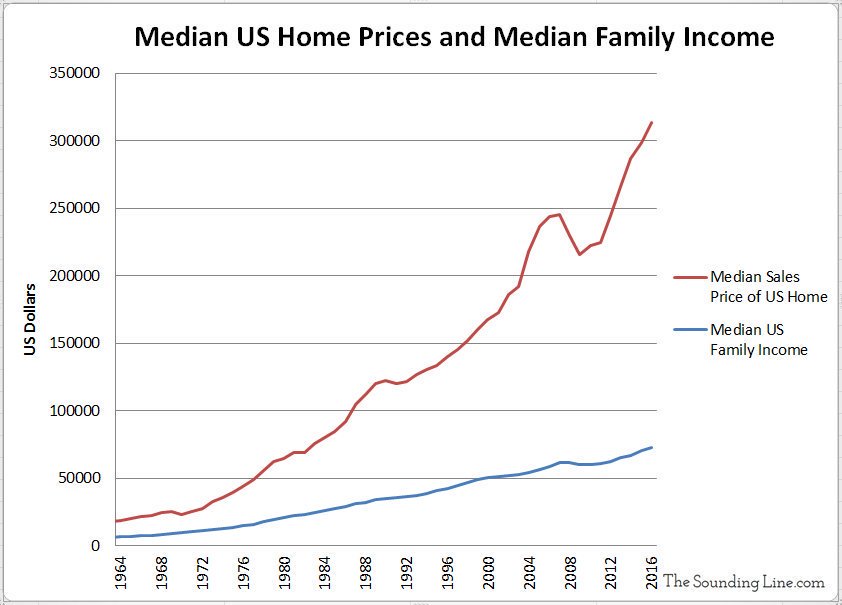

The principal reason for this increased savings time and lack of general affordability is the relationship between household income and home prices.

In 1960 the average household income was $5,600, and the average cost of a home was $11,900. These figures created an average ratio of house price to income of 2.125 (found by dividing the average house price of $11,900 by the average income of $5,600).

Price-to-income ratio is a commonly used metric in the housing market as well as finance. The price-to-income ratio stems from the general guideline that housing costs, whether rentals or a mortgage, and related expenses should not exceed 30% of the household’s gross income. As such, if a household spends around 30% of their income on a home mortgage, they can comfortably afford a home that costs about 2.6 times the amount of one year’s income. The average price-to-income ratio in the United States is today around 4.5, with a median ratio of 3.8, reaching historic highs.[3]

A quick example of how the 30% rule and 2.6 times one year’s income works: If the median household income is $67,000, 30% of its gross income would be $20,100, divided by twelve months; that is, $1,675 per month for a mortgage, insurance, and property taxes. If we multiply $67,000 by 2.6, the cost of the house that would be affordable within the 30% guideline, we get $174,200. A 30-year fixed rate mortgage on that amount is about $1,000 per month, leaving money for taxes and insurance and still enough to cover all other living expenses comfortably. The glaring issue is that the median home price in the US is around $420,000, with a mortgage payment of about $2,300 per month.

Since 1960 median home prices have increased 121%, with median household income straggling behind with a 29% increase as of 2017. Median rents have increased by 72%.[4]

The South and the Midwest regions of the US are the most affordable regions in the country. In the South, from 1960-2017, the median income increased by 49%, and the median home by 156%. For the Midwest, there was a 29% increase in median household income and an 82% increase in median house prices. These regions are “affordable” compared to the West, which has seen a mere 26% increase in median household incomes with a 195% increase in median home prices. This still looks affordable compared to outlier cities such as New York, Boston, Los Angeles, and San Francisco, that saw incomes increase by 54%, 71%, 32%, and 91%, respectively, while their median home prices went up by 184%, 228%, 358%, and 531%.

A different study looked at the median home prices from 1965-2021, finding that the median home price has risen 118%, while the median household income increased only 15%, a difference of nearly eight times.[5] Adjusted for inflation, since the housing market crash and recession in 2008 house values have increased over three times the rate of incomes. As house values recovered and increased, wages remained flat.

Historically in the United States, a large share of the middle class’ wealth was held in home equity. Now, as the difficulty of home ownership increases with each passing year and decade, the trend of substantial home equity is likely to continue to slow. Homeownership grows more out of reach with each American generation, reflected in lower ownership rates.[6]

This year, after interest rates jumped to 5.5%+ from much lower rates in the 3% range last year, the housing market has cooled after its hot run.[7] As a result of the higher rates, the buying spree has been slightly stemmed for now. In May, sellers started to lower prices on their homes; 15% of listings reduced their asking price. However, year over year, prices are still up 17%.[8] June saw about 15% of deals in contract fall through. The past five years have seen 11-12% of sales not closing.[9] Although this is a welcome sign to many hoping to buy a home or to get a respite from climbing rents, this is a minimal correction on a micro scale for a problem that has been gaining momentum for over 50 years.

You can buy Greg Johnson’s Truth, Justice, & a Nice White Country here

Home values are increasing beyond a function of inflation.[10] The median home in 1980 cost $47,200 and $79,100 in 1990; adjusted for inflation, those prices are $93,400 in 1980 and $101,100 for 1990. During some years, we have seen home price increases outpace inflation by double.[11]

We’ll look at and make a quick note concerning the popular commentary surrounding the housing market trends from a CNN article and a study by King’s College London.

First, there is a CNN article titled “These Entitled Millennials Are Cheering for a Housing Market Crash.”[12] This piece is the typical fare from out-of-touch journalists. Instead of making a good faith attempt to unearth the issues in the housing market and economic landscape most people face, the entitled journalist instead mocks people who are desperately expressing legitimate concerns over housing prices and general instability.

The King’s College London study found that over half of Baby Boomers believe “luxury lifestyle” items are to blame for the younger generation’s inability to buy a home.[13] Although it can be easy to dismiss and hold Boomers in contempt for suggesting that the younger generations merely need to “cut back a little,” I’ll offer a different approach. Boomers, for the most part, live in a world that doesn’t exist anymore. They still believe that if you go to work, work hard, and have even minimal levels of financial discipline, you can relatively easily “make it” in the United States.

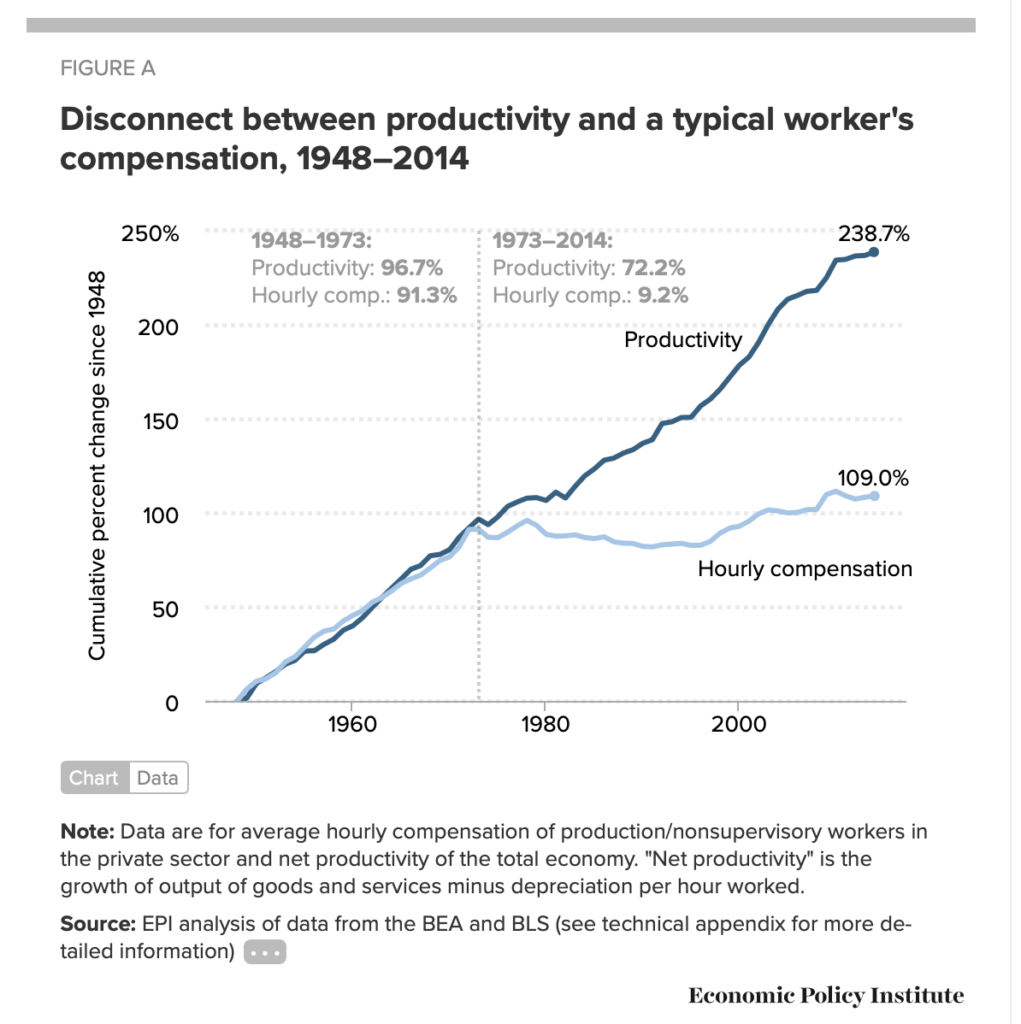

They come from an era when the average home cost was 2.5 times or so the average salary; when wages were still keeping up with inflation, productivity, and company profits; and when the supply of houses was not eaten up by over a million new immigrants per year, who at the same time drive down wages.[14] The world Boomers matured in, worked in, bought houses in, and invested in does not exist anymore. Perhaps at some point in the 1970s, when gas prices and interest rates were high, cutting back on unnecessary luxuries would have been fine advice to someone for remaining solvent and financially stable. However, as we have seen, that world might as well be another country. A country where the average person could count on earning enough money in the next year to at least keep up with rising costs has not been the trend for quite some time now.

Essentially, many Boomers are operating on outdated “rules of thumb” that are becoming increasingly irrelevant. Cutting out coffees and Netflix, and many other small luxuries for that matter, will not add up to an amount anywhere near what is needed to deal with housing costs. Costs are outpacing incomes by more than an entire year’s worth of pay compared to when the Boomers were buying homes for the first, second, or third time.

From Fortune we have, “What causes a recession? Maybe it’s you and how grumpy you are about the economy.”[15] This theory is interesting beyond its inflammatory headline, essentially being an argument that low consumer confidence often precedes an economic downturn and may be causal. The author points to some factors, such as high employment levels, as a reason people should be more optimistic about the economy, which could cause a recession. Two glaring flaws are present: first, assuming that something like low unemployment matters when employed people see their wages being outpaced by the cost of living and inflation; and second, assuming that consumer feelings are baseless and irrational. I do not believe this is the case.

I have seen and heard many comparisons of our present situation to the 2008 housing market. They speculate that this market is another bubble and that prices will fall or crash, providing some relief to those being priced out of ownership and where rent is squeezing them economically. There are several issues with this idea. First, even if prices begin to fall, it doesn’t translate to higher supply. Mortgage delinquency rates are much lower today than in 2008 — one signal that the current trend is substantially different from before. In 2008, people lost homes to foreclosure largely due to lending practices, meaning their homes were returning to market supply while driving down prices overall.[16] Another is that many institutions and foreign investors are now buying single-family homes, adding to the supply shortage, and whose position is presumably much more stable than that of the sub-prime borrowers and their lenders of 2008. Finally, even if there were a 2008-level crash, as we have seen, the home prices would likely recover at a rate outpacing income. Unless the prices crash by a genuinely biblical proportion, such that values are reduced by half or more, the price-to-income ratio would still be such that average Americans will be struggling to afford a home. Not even the 2008 crash itself was able to reset the median price-to-income ratio to a historically “normal” level. Thus, there are minimal signs that a housing crash now would do such a thing.

As housing, utilities, fuel, food, clothing, and transportation costs all rise, at least partly as a function of inflation, the majority (75%) of middle-class households surveyed (those earning $30,000-$100,000 per year) say they are beginning to fall behind.[17]

I have noticed several trends over the past few years beyond low-interest rates that contributed to the heated housing market. We saw dozens of offers on every house for sale in many parts of the country, cash offers well over asking prices, buyers waiving inspections with their bids, and low supply on the market. Several things happened almost all at once: Black Lives Matter riots all over the country that lasted through the summer of 2020, the rise of liberal district attorneys with an incredibly soft attitude towards crime (for certain crimes and specific demographics), Covid lockdown policies, and the institutional mass buying of single-family homes by heavily-funded asset management firms such as the Blackstone corporation. In short, we are in an intersectional dilemma where liberal public policy, black crime, white flight from the cities, and leviathan investment corporations all come together to create a terrible strain on most people.

A country feels less and less like it is “yours” when you can no longer own a home if you’d like. I have seen houses on moderate-sized lots in my area sell for $350,000 or more, whereas comparable houses were selling for $250,000 several years ago, and for half of that around 2008. The liberal urbanite and suburban white flight is always troubling. As the larger cities have seen a wild increase in crime since 2020, the same people who support Black Lives Matter are fleeing the violence and property theft, moving into different suburbs or more rural areas, increasing the housing costs for those who already live there, and then display pride and BLM flags on their new lawns, inviting the exact problems they just fled.

If that was not vexing enough, the exodus from the cities and institutional buyers drive up the housing costs and property taxes along with them, effectively taxing many people out of houses they could once afford due to the increased tangential costs of home ownership.

The World Economic Forum catchphrase “You will own nothing, and you will be happy” stalks us still. Those who have already purchased a home and built equity will likely continue to be pressured by rising property tax rates as homes around them trend upward. The same pressures loom for those who may inherit a home or equity in a house. There have been people I know who have essentially been forced to sell their homes due to rising costs of living and property taxes. With the sale, they may be flush with cash but have nowhere to go, so they will rent, perhaps indefinitely.

According to a 2018 study, a survey of Americans found that 82% of respondents said their idea of the “American dream” is financial security for themselves and their families, with 75% saying that owning a home is part of that dream.[18] The same study reported that a third of those surveyed said the American dream is slipping away. Sadly, I cannot help but agree with that sentiment.

* * *

Counter-Currents has extended special privileges to those who donate $120 or more per year.

- First, donor comments will appear immediately instead of waiting in a moderation queue. (People who abuse this privilege will lose it.)

- Second, donors will have immediate access to all Counter-Currents posts. Non-donors will find that one post a day, five posts a week will be behind a “Paywall” and will be available to the general public after 30 days.

- Third, Paywall members have the ability to edit their comments.

- Fourth, Paywall members can “commission” a yearly article from Counter-Currents. Just send a question that you’d like to have discussed to [email protected]. (Obviously, the topics must be suitable to Counter-Currents and its broader project, as well as the interests and expertise of our writers.)

- Fifth, Paywall members will have access to the Counter-Currents Telegram group.

To get full access to all content behind the paywall, sign up here:

Paywall Gift Subscriptions

If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

- your payment

- the recipient’s name

- the recipient’s email address

- your name

- your email address

To register, just fill out this form and we will walk you through the payment and registration process. There are a number of different payment options.

Notes

[1] Skylar Olsen. “Home Buyers Need 7.2 Years to Save Down Payments – 1.5 Years More Than in 1988.” Zillow. October 22, 2018.

[2] “Historical Mortgage Rates and What Today’s Rates Mean for Home Affordability.” My Move. March 11, 2022.

[3] Alexander Hermann. “Price-to-Income Ratios Are Nearing Historic Highs.” Joint Center for Housing Studies of Harvard University. September 13, 2018.

[4] Eylul Tekin. “’A Timeline of Affordability: How Have Home Prices and Household Incomes Changed Since 1960?” Clever. August 3, 2021.

[5] Jessica Dickler. “Home prices are now rising much faster than incomes, studies show.” CNBC. November 10, 2021.

Michelle Delgado. “U.S. House Prices Are Rising Exponentially Faster than Income (2021 Data).” Real Estate Witch by Clever. October 25, 2021.

[6] Laurie Goodman and Jun Zhu. “By 2040, the US Will Experience Modest Homeownership Declines. But for Black Households, the Impact Will Be Dramatic.” Urban Institute. January 21, 2021.

[7] Katie Collins. “Historical Mortgage Rates: Averages and Trends.” Time. July 29, 2022.

[8] Sarah Hansen. “More Home Sellers Are Dropping Their Asking Prices – but Don’t Celebrate Yet.” Money. May 9, 2022.

[9] Patrick Clark. ”Home-Sale Cancellations Jumped in June as Buyers Backed Away.” Bloomberg. July 11, 2022.

[10] Emmie Martin. “Here’s how much housing prices have skyrocketed over the last 50 years.” CNBC. June 23, 2017.

[11] Ryan McMaken. “U.S. home prices are rising twice as fast as inflation.” Business Insider. May 2, 2016.

[12] W. E. Messamore. “These Entitled Millennials Are Cheering for a Housing Market Crash.” CNN. September 23, 2020.

[13] Kieran Gair. “Baby boomers say struggling young should cut Netflix.” The Times. June 13, 2022.

[14] Josh Bivens and Lawrence Mishel. “Understanding the Historic Divergence Between Productivity and a Typical Worker’s Pay.” Economic Policy Institute. September 2, 2015.

Steven Frank. “Gap between corporate profits and wages grows to post-war record.” MSNBC. December 5, 2012.

[15] Will Daniel. “What causes a recession? Maybe it’s you and how grump you are about the economy.” Fortune. June 4, 2022.

[16] “Mortgage delinquency rates in the United States from 2000 to 1st quarter 2022.” Statista.

[17] Sarah O’Brien. “75% of middle-class households say their income is falling behind the cost of living.” CNBC. July 18, 2022.

[18] “Was it only just a dream?” MassMutual. August 21, 2018.

The%20Fading%20Memory%20of%20American%20Homeownership

Share

Enjoyed this article?

Be the first to leave a tip in the jar!

32 comments

Some could write an article on the dramatic increase in automobiles over the years as well.

I believe you had in mind Blackrock. More about what they do other than buy real estate:

https://www.bitchute.com/video/LKBIdXUGTDgm/

https://www.youtube.com/watch?v=iZsuTYCa4KE

Blackstone and BlackRock are two different companies and doing different things in the real estate markets. Blackstone is buying a huge amount of single-family homes. BlackRock is in other sectors such as large multi-units.

This guy is a genius. He never seems to miss on this sort of stuff.

He certainly is.

I think it’s safe to say he’s the smartest white nationalist named Richard.

If you owned a house in 1968 it literally quadrupled in value by 1974. That does not take merit. You could work at Macdonald’s in 1990 and own a home because you got a loan. This is why Boomers have so much wealth. But at the end of the day there is no such thing as homeownership in this country because we have eminent domain. Also, if you miss enough utilities payments or violate zoning laws/covenants your house can be seized. I have never understood investing in thIngs you can’t control like the value of your property. If the wrong ethnicity moves down the street because of HUD it will drive down the value of everything around it and you are at its mercy. It seems like an unnecessary gamble.

It seems like an unnecessary gamble.

You’re gambling either way. If you don’t buy, you’re taking the chance that your rent will not increase disproportionately and price you out of your local housing market altogether. How do you even plan financially if you don’t know what your housing costs are going to be when your lease is up? I can’t imagine living with that kind of uncertainty.

And, at least in my modest neighborhood, there is no way your average young couple is going to save up 20% for a down payment in 5.7 years. They will never be able to save that kind of money while they’re paying their landlord’s mortgage, making student loan payments, and paying for child care. No way in hell. They will rent for the rest of their lives unless they delay children and/or some student loan relief is forthcoming.

Its so bad now that if I didn’t have a family I would probably buy an inexpensive van to sleep in and shower at the gym. People are also paying more money (as a percentage of overall income) for increasingly faker and less nutritious food, cars, clothes, and other necessities. The boomers may have a bit of a point with the “cut down on non-essentials” but there is a lot of psychology and research that has gone into the conditions making people more or less unable to resist the non-essentials.

Another homerun from Wild Rich. Thank you.

This article is definitely worth sharing with “pro-Whites” who don’t believe that the same globalists pushing the Great Replacement are also trying to attack us through another angle: denying us the ability to own property and raise a family. Immigration is not their only ace up their sleeve.

Great Reset issues like skyrocketing price-to-income ratios are also great for bridging our primary concern (race) to normies. The Great Reset is not a “distraction” at all.

Exactly. They want everyone to “own nothing and be happy” while they’re laughing all the way to the bank. That is, they want to take away our property and rent it back to us.

It’s things like this that are the reason why I’ve always been hesitant to criticize young adults for “living in mom’s basement”.

The expectation for young people to fly the coop as soon as they graduate high school seems to be a relatively recent development.

I could be wrong but I think it was far more common in the past for children to reside with their parents until and sometimes even after marriage.

It seems more and more that the only way to win these games they play, in this case gouging home buyers, is to not play at all.

You are right. This business of kicking the kids out the moment they’ve finished high school is relatively recent. Yes, it’s all a capitalist plot – millions more households c/w all the accoutrements. And of course young folks living alone are more prone to get into various forms of trouble if the parents are not there keeping an eye on them. That, too, is part of the picture. DPs don’t as a rule throw their offspring out – even single professionals will live at home with the old folks. It’s largely a white practice, this rush to disconnect. Living in parents’ basement is considered the ultimate sign of “loser” today. Let’s not be manipulated by those who have an agenda.

Boomers were the first generation to kick their kids out at 18, and shove their own parents in nursing homes. This isn’t common in other countries

While you are right that Boomers are over-represented in kicking the kids out the moment they are done with high school, they were not the first generation to come up with the idea. The “forgotten generation” did plenty of that, as well. In my mum’s family, all the kids, girls included, were given the boot even though they were all “good”, obedient children. I think that my shitty grandparents, having come from unbelievably poor backgrounds, themselves thrown to the wolves, made sure their offspring suffered as well. Their neighbors’ children suffered the same fate, at least the ones I know about.

With hard times having arrived and getting worse every day, families should try to stick together. It works for the DPs. Some white young folks hate their families, though, and can’t wait to leave. Meh.

The go-to explanation for the divergence between productivity and wages is often financialization. Indeed, the inflection point in the wages line does correspond to the mid-late ‘70s, the rough point at which most would pin the start of the explosion in the GDP share sucked out by the FIRE sector.

But there’s another compelling explanation: It was also arguably around that time, and accelerating sharply thereafter, that computer-based automation began having a deep impact on manufacturing. The resulting gains in efficiency were further extended by offshoring and, in some sectors, continued technological improvement.

Thus today, one can buy a 50” high-definition TV for $300 that as late as the 1990s would have easily cost 10-20 times that. The same holds for most manufactured goods. A new Hyundai Sonata has comparable performance to an early- ‘80s Ferrari 308 and vastly better technology at maybe 1/10th the cost. This logic is the basis for the so-called hedonic adjustment to inflation.

But real-estate inflation is now much more than offsetting any hedonic adjustments, real or contrived. And it’s not surprising. The fact is that none of the factors above, automation and offshoring, have any meaningful effect on real estate prices. Despite advancements, raw materials still need to be converted to building supplies, and skilled labor still must be harnessed in construction. The complexity of the building environment is such that automation is not likely to soon make any substantial dents in building costs, at least at the single or multi-home level.

Another factor in play is the sharp decline in marriage rates. Whereas in the 1970s, over 70 percent of households were married couples, that figure is well below 50 percent today. It suggests that many of today’s households are an ersatz mockery of households of yore. For instance, I have a roommate. There is zero chance in hell I, nor any bank, would go in on a house with this individual even though his Social Security checks apparently boost our 100 percent totally segregated “household income”. “Households” consisting of Slorethot and Guy W. Tinder probably have mortgage bankers preferring to lend to a vial of nitroglycerin. While marriage practically demands homeownership, many of today’s “households” are rental-made and ephemeral when it comes to buying a home.

And this suggests that real affordability might well be indexed to a number somewhere between household income and more-viable individual income for a given vicinity. Going with where I live and therefore using an adjusted median income figure of $45,000, at the current 5.5 percent savings rate, it would take 21 years for this median-income-earning modern household to save up for a 20 percent down payment on the median $264,000 house. They’ll be renting.

What should be done? We must first ask what could be done. It’s tempting to point to the demolition of freedom of association as a major cause. While excising .gov’s subsidy tentacles from the housing market could be nothing but good, the plain fact is that freedom of association largely still de facto exists in all but the slummiest urban housing markets. The wreckers themselves provide the best evidence.

On the other hand, knowingly converting the postwar US economy from one based on manufacturing to one based on administration and services had a serious flaw; it’s scoffing at if not quite violating Say’s Law. Production must precede consumption. Baristas are great. But they don’t keep the furnaces blasting or the fan blades spinning.

Mass immigration and black dyscivics no doubt have a strong inflationary effect on housing. But in the main, Americans are losing their purchasing power of core goods in large part because they no longer produce likewise core things in kind.

Mass immigration and black dyscivics no doubt have a strong inflationary effect on housing. But in the main, Americans are losing their purchasing power of core goods in large part because they no longer produce likewise core things in kind.

The problem is that Americans can afford the things we don’t produce anymore: clothes, consumer electronics, etc. It’s housing we can’t afford. Most Americans’ wages have been eroded by outsourcing and automation, and the younger generations can no longer afford houses built to code by skilled Americans. Some young people are trying to beat the system with tiny houses on wheels, or even just small stick-built houses on unrestricted land, but that’s not really going anywhere because of NIMBYism among the callous house rich.

The idea I was getting at is to extend Say’s law. You have a core/periphery circle, with things like Peloton subscriptions orbiting the outer reaches and steel production near dead center. The idea is that, all things being equal, in order to consume goods roughly falling in a given concentric band of the circle, an economy must first produce commensurate goods within that band.

In other words, the more you bullsh*tize your economy, the less you can afford non-bullsh*t goods. Clothes are important. But they’re now mostly an inexpensive, mass-produced commodity (relatively peripheral). For consumer electronics, this is even truer.

Far more critical (core) are things like housing, energy and building materials. And much of the US economy — HR, DIE, metastatic bureaucracy — has simply become consumption masquerading as production, economic antimatter drifting far outside the Peloton-subscription belt.

Given two identical economies, if the second repurposes some of its workforce from core production to peripheral production — e.g. firing engineers from an oil refinery and retraining them as diversity consultants — then the second economy will commensurately lose its purchasing power of those core goods.

It’s housing we can’t afford… and the younger generations can no longer afford houses built to code by skilled Americans…Some young people are trying to beat the system with tiny houses on wheels… but that’s not really going anywhere because of NIMBYism among the callous house rich.

Good observation about houses becoming too expensive. The average size of homes has increased since 1950 but finally began trending downward slowly in 2015. Not exactly houses on wheels but ticking downward slightly. That’s either good news for us or the brown people who want to replace us. Depending on the birthrates, whether we ever stop mass immigration, etc.

https://www.statista.com/statistics/529371/floor-area-size-new-single-family-homes-usa/

Don’t forget the astronomical amount of student loan debt people have coming out of college. This makes it more difficult to buy a home as well.

Richard’s articles are always salient. It is a difficult time to be a first time homebuyer, especially if you want to live in a White neighborhood in a suburban area near job opportunities. Where I’m looking, the White tax is about an additional 100k. The same house that would be 350k in a nonwhite area is 450k in a white area.

I agree with Rich 100% on this. These are facts.

One issue of note when discussing home affordability is the ever-increasing tax burden.

Some jurisdictions cannot seize your real estate for non-participation in their extortion scheme unless you are not the true owner (i.e. mortgage). The liens they place on the property have no legal force until official transfer of ownership through sale or inheritance, but may affect your ability to use banking services or operate a business.

Something to consider.

An excellent, well-researched article, Rich. The problem of astronomical housing prices is even worse in the other anglosphere offshoots-Canada, Australia, and New Zealand. And of course their anti-white mass immigration policies are just as bad if not worse than America’s.

But even Trudeau said he would pause foreigners buying houses in Canada… Biden would never do such a thing. He has zero sympathy for the old stock Americans.

The book, “Makers and Takers: The Rise of Finance and the Fall of American Business” by Rana Foorohar does a good job explaining how the financialization of Western economies since the early 80s (unleashed by the deregulatory policies of people like Reagan and Thatcher) have been a direct cause of the drastic rise in house prices. The importation of 1.5 million immigrants into the country every year is the other conveniently overlooked cause, of course, while mainstream buffoons will drone on and on about “supply and demand”.

This issue strikes me as one of the most important ones we face. For me, it’s a personal crisis, but surely anyone see the civilizational threat when young people cannot afford to marry, have children and buy shelter. I can’t believe more people aren’t screaming from the rooftops about this.

Thank you for writing this article. I’m Gen X and homeownership was delayed because I wasn’t born into wealth and now the pandemic has dashed this dream. I have our 20% saved finally at this late stage but it doesn’t matter now because our taxes for the last 2 years show income loss due to pandemic lock downs. My husband wasn’t part of the “lap top class” who could do his job “remotely”. Am I bitter? You bet!

Believe me “toast”, I’m bitter too (Gen Xer here as well). I grew up in a community where we had lived for 4 generations, where old people would randomly regale me with tales of my great-grandparents when they were young. I married and had children here, but we just can’t hang on anymore. And now my home and my hometown have been turned into financial instruments that are being snatched up by hedge funds, investments banks, Orthodox Jewish communes, hordes of Chinese people with 100 year mortgages from ethnic banks, and legions of people from the next city over, who have been priced out of their own community, but whose high sale prices they got for their homes allow them to buy up ours for cash.

I can “afford” a house, but I’d have to live over 80 miles away from where I work. Renting anywhere isn’t even an option anymore, the prices being so stratospheric, so if I’m lucky I’ll get this house in the hinterlands for my family and get used to van living a few days a week.

One of the most irksome aspects of the whole thing is the myopic “I’ve got mine, Jack” attitude exhibited by everyone who was lucky enough to have gotten into the market (funny term for a human need) already. But I insist on asking them, “But where are_your_children and grandchildren going to live when_they_grow up in a few years?” Unless they are smart enough or lucky enough to enter the small and ever-shrinking minority of 20-somethings with incomes around 100k, then they will either move back in with you or go very far away. And yet another family is broken up, and another community turned to ashes.

Thank you for your reply. It hit home for me because I have old black and white photos of my Grandparents who were the first to build a house in their Southern California neighborhood! There was only dirt and a smile on my grandfather’s face as he posed with a shovel for effect.

I live in a new state now and I do worry this scenario of having to move will repeat.

You make a great point about this as these fears are real for parents who worry.

Also a side note, I see something happening here and I’m not sure if others see it elsewhere too but I see “black flight”. We have a lot of blacks moving here from PA,Detroit, and Chicago. Something I don’t recall seeing here previously when I spent summers here.

Even if live in houses, we are still dispossessed. Our country overrun by the Third World, our towns turned into tradeable assets, our kids forced to become nomads because of the manipulation of the housing market. I want a revolution.

🎯

So are the investment firms buying single family housing the cause of the trend of the increasing home price to average income ratio? That 2.125 ratio figure from 1960 is insane. The trend is for sure there but what is causing it?

The suburb of my hometown is going to hell in a handbasket but houses are a fortune. Houses that would be in the six digits ten years ago are now selling in the low millions. But yin and yang, the local health food store effective mid July this year no longer has public restrooms due to drug addicts using them to shoot up. It’s basically the result of years of the new metro line that has run through the suburb. In essence the homeless are being spread out. There tent encampments and homeless with shopping carts on one of the main roads. What was most suspicious of all was the building of a small old folks home in my neighborhood. It’s just a few units and looks like a single family home but I think this is the suburb slowly seeing what it can get away with. I think within the next couple years, the local government will put a section 8 apartment complex right in the middle of the neighborhood once the right house is for sale and with of course the right amount of federal grant money.

Good article.

Since 1960 median home prices have increased 121%, with median household income straggling behind with a 29% increase as of 2017. Median rents have increased by 72%.[4]

Since 1950, the average square footage of a single-family home has gone up from 983 to 2,392 or by 243%, yet the average number of people per household has gone down from 3.67 to 2.55 for a decrease of 31%. This means that US citizens occupy 3.5 times more space than they did in 1950. Probably amounts to nothing but extra TV echoes for most. Those 32-56 are twice as likely to buy a home over 2,500sqft than those under 32. Wonder if the correlation between house size and house price is changing. Maybe it’s decreasing and the large average size of houses have dragged the overall price of even the small ones up because people are trying to save money by opting for small ones, but the more people who try to do that then the less additional people can save while doing it other things being equal.

What’s sad is that yard sizes are going down. No room for the kids to play or dogs to run. Extra land>TV echoes imo.

Comments are closed.

If you have a Subscriber access,

simply login first to see your comment auto-approved.

Note on comments privacy & moderation

Your email is never published nor shared.

Comments are moderated. If you don't see your comment, please be patient. If approved, it will appear here soon. Do not post your comment a second time.

Paywall Access

Lost your password?Edit your comment