1,586 words

I should preface this by saying I’m not a licensed investment advisor. Only risk what you are willing to lose. That goes for any investment, whether it’s government bonds or expired yogurt. Bitcoin is one subject that causes a lot of disagreement. Many people think it’s a scam. It’s often cited jokingly as the cause of someone’s wealth, or their poverty. It has been around for more than a decade, and yet many people still file it away in their minds as “that newfangled thing that’s a bubble that will fall to zero any day now.” The whole concept seems pretty bizarre and unnecessary if you aren’t a geek for monetary theory.

I should preface this by saying I’m not a licensed investment advisor. Only risk what you are willing to lose. That goes for any investment, whether it’s government bonds or expired yogurt. Bitcoin is one subject that causes a lot of disagreement. Many people think it’s a scam. It’s often cited jokingly as the cause of someone’s wealth, or their poverty. It has been around for more than a decade, and yet many people still file it away in their minds as “that newfangled thing that’s a bubble that will fall to zero any day now.” The whole concept seems pretty bizarre and unnecessary if you aren’t a geek for monetary theory.

But if you take the time to learn about the history of money, and why certain things become very valuable despite being mostly useless, then Bitcoin makes a lot of sense. I’ve tried to condense my most worthwhile ideas here because I want to influence a few fellow White Nationalists to take a stake in it. As it stands, most of us are aware it’s a good medium to bypass PayPal and banks to support fellow nationalists we care about. The fact it can’t be frozen or confiscated is a blessing for all dissident thinkers. But there’s much more to it.

1. It’s worth investing in. It isn’t a currency so much as it is a cyclical commodity that’s still in the process of filling out. It is a convex, non-correlated, bearer asset, that isn’t yet available via traditional brokerage and custodial firms. That means buying it now gives you a huge leg up on multi-trillion dollar pools of capital that want exposure to this commodity, but can’t yet get it. Hedge funds and family offices love non-correlated assets because they provide potentially good returns when the stock market is down.

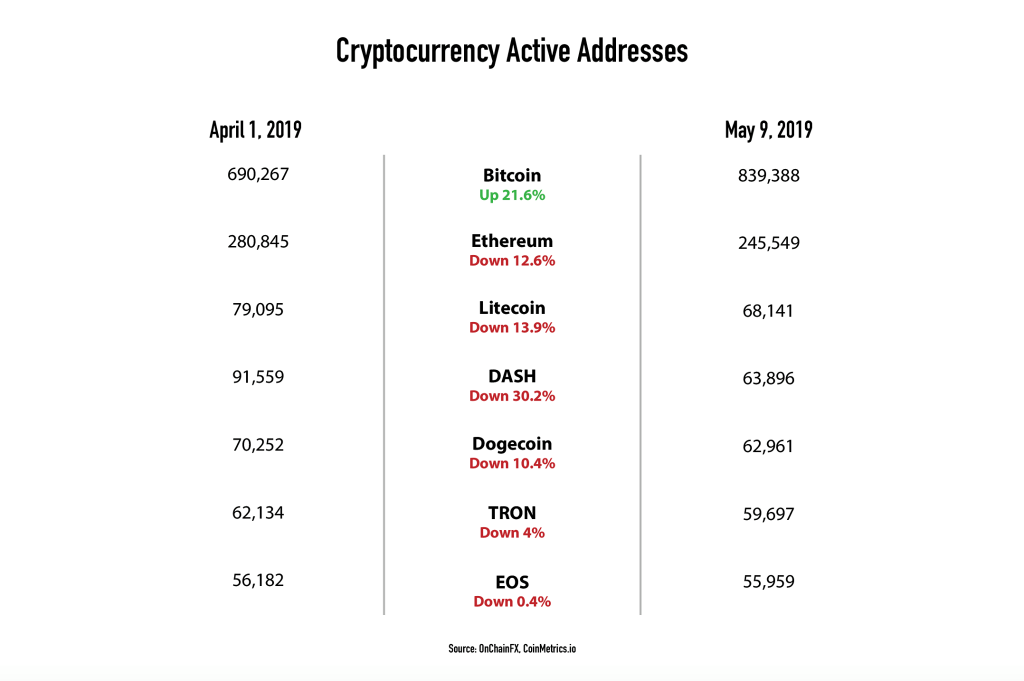

2. Don’t buy other cryptocurrencies. Bitcoin’s network effect and liquidity advantage make it insurmountable within its class. Alt-coins come and go. Bitcoin will remain on top.

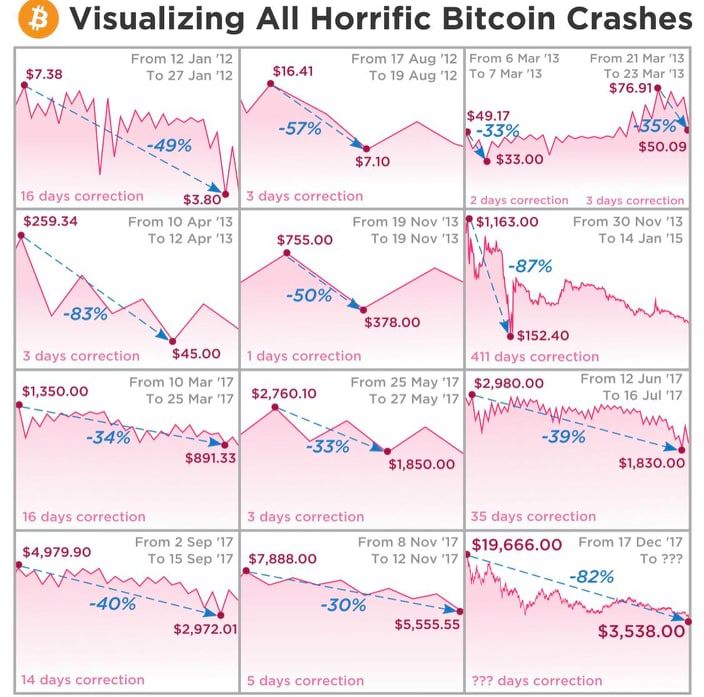

3. Hold it long term. It’s best to think of owning Bitcoin like owning shares of Microsoft before the PC craze really took off in the ’90s. It will have periods of huge gains, and periods of gut-wrenching crashes. But if you can hold for 10 or more years, you will likely benefit enormously.

4. Avoid trading it. Trading any crypto means recording every buy and sell order you make, and calculating the profit/loss on each one. It’s a huge pain, and the vast majority of traders end up losing money. The buy and hold strategy is much better.

5. Don’t fall for scams or the “blockchain technology” mumbo jumbo. There are thousands of people in the cryptocurrency sphere who try to get people to invest in their business ideas and tokens. Don’t get sidetracked. You only want Bitcoin.

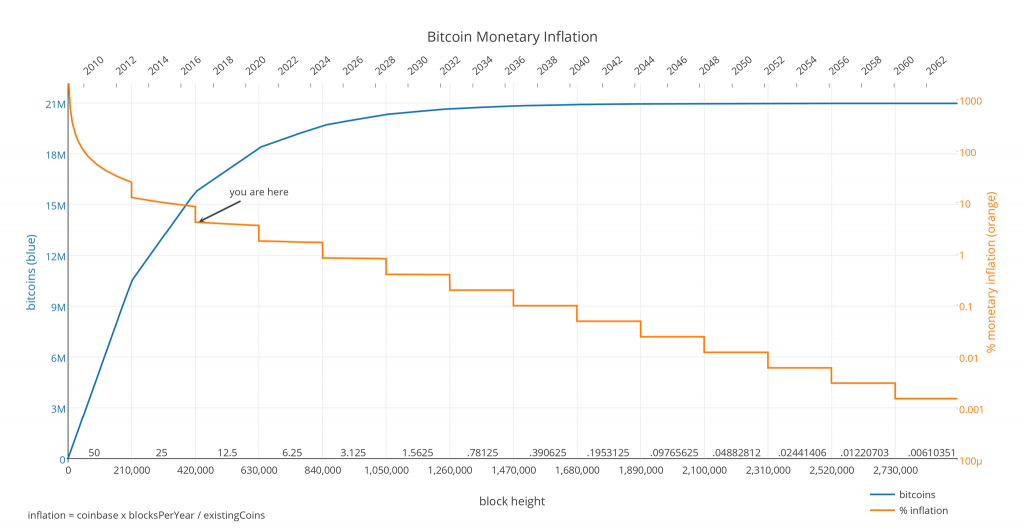

6. Bitcoin’s growth phase will likely last another 15 to 20 years. There is a good chance it will destroy several fiat currencies along the way. Nobody knows for sure how the market will react to its rise – it might become a large commodity like gold, or it might supplant government money and be used in day to day transactions. Bitcoin maximalists like Pierre Rochard theorize it may create a springboard from which speculative attacks can be launched against fiat currencies, wherein traders borrow fiat in order to buy BTC. This drives down the value of fiat, while driving up the price of BTC. The cycle continues until the fiat hyperinflates. A similar process was used by George Soros when he attacked the British Pound.

7. The high volatility of Bitcoin doesn’t matter. In fact, it’s a good thing. People who complain about the dramatic price swings lack teeth and can only eat applesauce. If you want stability in your investments, then you are in the extreme minority. Most people want to own things that go up in value, not sideways. While it’s true that Bitcoin crashes every so often, each crash lands at a far higher level than the previous crash, due to the massive influx of new people accumulating and hoarding the digital commodity in anticipation of the next bubble cycle. You can’t have a smooth, steady climb from zero to a multi-trillion dollar commodity. Markets just don’t work like that. There are manias and depressions along the way. The volatility is a symbol of life, vitality, youth. It attracts traders, which provide added liquidity to the market. It also generates headlines, which ensures Bitcoin will be in front of many more potential buyers.

8. Bitcoin is a bet on globalism. That’s not to say it helps globalists, however. It severely limits their ability to track and control the flow of capital, which means sanctions and censorship become much harder. But if you are a nationalist, and you want to be well-hedged, it makes sense to own a commodity that facilitates global trade. Make the bad guys work for you.

9. Bitcoin is not totally anonymous (unless you jump through some hoops, and you’re technically savvy). So don’t expect full privacy.

10. It’s a store of value. This is the most important thing to understand. The key to Bitcoin’s success is simple: the 21 million coin limit. Forget about anonymity, the dark web, blockchain technology, etc. Those other things are secondary. For the first time in human history, we have a commodity with a mathematically limited supply and a predictable mining schedule. That makes it the best store of value that has ever been available to investors. I recommend the book The Bitcoin Standard by Saifedean Ammous for a good explanation of the history of money and why Bitcoin is the best money-like token that has ever existed. Even gold has a higher rate of supply-increase than Bitcoin. When the value of gold climbs, miners are incentivized to dig up more of it. Thus, the rate of supply-increase climbs, which then tempers the price by flooding the market with more gold. This same effect can’t happen with Bitcoin. As the price of Bitcoin rises, the network adjusts mining difficulty higher to avoid flooding the market with extra coins. So the supply increase occurs exactly as scheduled. An analogous situation for gold would be if the metal magically buried itself deeper in the ground the higher its price went. And we somehow magically knew there were exactly 21 million kilograms of gold, no more or less.

11. The Average Joe doesn’t need to own any Bitcoin for it to become extremely valuable. Average people are among the last to own any worthwhile investment. All it takes are a few billionaires and a couple hedge funds to bid up the price of Bitcoin into the stratosphere.

12. The Bitcoin network can only process around 7 transactions per second, compared to Visa and Mastercard which can process more than 10,000 transactions per second. But the rate of transactions and retail purchases don’t matter, for a couple of reasons. The first is that Bitcoin’s value comes from the fact it is impervious to inflation and censorship, not because you can buy Starbucks with it. The second is that the blockchain, while severely limited, is more than sufficient as a global “base layer” for settlements. Second layer solutions such as the Lightning network are currently being built that will make it possible to send and receive even more transactions than credit card companies can handle, and with greater privacy.

13. Avoid Coinbase. They ban people for political dissent.

14. Not your keys? Not your coins. Don’t trust someone else to store your BTC for you. I recommend storing them on a Trezor, or learning how to create a secure offline wallet.

15. Have backups of your wallet. Hide them in various locations so you can have peace of mind that you’ll still have access to your money even if your house burns down.

16. Immediately after you buy BTC the price will fall. It’s like a law of nature, so just accept it. But when Bitcoin goes up, it tends to go up very quickly.

17. When you sell (in 10+ years), keep records and pay your taxes. The government already hates nationalists and white people, so don’t give them an excuse to harass you.

18. The bad guys are eventually going to want to own it. We are already starting to see some Wall Street players and Israeli businessmen pushing Bitcoin hard, trying to get their fellow tribesmen on board. There’s even a self-styled “Bitcoin Rabbi” on Twitter who has written a children’s book on the subject. Predictably it features a white girl with a black boy on the front cover. On the other hand, several prominent Jews have come out swinging against Bitcoin, including congressman Brad Sherman who recently said he wants to ban it because of its potential to overtake the dollar in global trade. Joseph Stiglitz, a Left-wing Jewish economist, just said “we should shut down the cryptocurrencies.” Nouriel Roubini called it “the mother and father of all bubbles.”

If governments could shut it down, they would have done so several years ago. Over time these people will come around and begin accumulating. Then they’ll start to publicly advocate for it. It’s inevitable. But before that happens, White Nationalists should already be well positioned. This is a race, and it would be a shame if we missed out on an opportunity to become financially independent (in more ways than one). Bitcoin offers us the opportunity to have money to start our own businesses, support each other, and speak our minds publicly without fear of being shut out of the economy. The first step in that journey is to start hoarding like Smaug.

What%20White%20Nationalists%20Should%20Know%20About%20Bitcoin

Share

Enjoyed this article?

Be the first to leave a tip in the jar!

Related

-

Counter-Currents Radio Podcast No. 616 Part 3

-

Counter-Currents Radio Podcast No. 592: The Counter-Currents 14th Birthday Telethon

-

Counter-Currents Radio Podcast No. 582: When Did You First Notice the Problems of Multiculturalism?

-

Counter-Currents Radio Podcast No. 565: The New Year’s Eve-Eve Special

-

Counter-Currents Radio Podcast No. 561: An All-Star Thanksgiving Weekend Special

-

Counter-Currents Radio Podcast No. 560: Is Elon Musk the New Henry Ford?

-

Counter-Currents Radio Podcast No. 558: Has Jewish Power Peaked?

-

Counter-Currents Radio Podcast No. 528 Karl Thorburn on the Bank Crashes

19 comments

I think Bitcoin is a Ponzi scheme. However, I have been contemplating owning a small amount, much as this article advocates, because I have a feeling it will retain some utility going forward, especially if there is widespread drop in confidence in fiat currencies. If one is ever stuck in a failed state situation like Venezuela, bitcoin could turn out useful. And who knows when our financial elites will turn again to bitcoin for the next pump and dump trick, as the author alludes, I think.

I dispute the comparison to gold and calling bitcoin a commodity, however. A commodity needs intrinsic worth outside of a medium of exchange. For example, gold has utility in decoration and art, as well as utility in electronics. All premodern monies have an intrinsic utility; salt, tea, cowrie shells(decorative). Bitcoin has inverse utility, as it costs energy and computer time to “mine.”

I would be interested to read the author of this article’s opinion of gold and other things.

You are sure it is a Ponzi scheme but you clearly don’t know what a Ponzi scheme literally means.

Pyramid, ponzi, bubble, one of them! I do think bitcoin was created with honest, libertarian intentions, but then humankind got their hands on it.

I think it’s very fascinating, and the theory of money generally fascinating. I especially like what the article points out about how bitcoin is retaining staying power against the other cryptos. Ultimately, confidence makes a currency. Some Magic cards have gone up 1000%. Are they “money” or a tulipomania?

I’m glad you enjoyed the article. I recommend you read Nick Szabo’s essay “Shelling out”. He talks about the history of money, and why value clings to otherwise worthless tokens. Bitcoin has a few advantages over tulips – the supply of tulips can be dramatically increased if the market demands it, whereas the supply of Bitcoin cannot. Also you can’t send tulips or gold over the internet. And hiding/securing gold is difficult because you need to buy an expensive vault. Gold became money because it was difficult to mine, until the advent of better excavating technologies. Now the supply of gold increases by about 1.5% a year (and climbing). Gold is already a widely available and widely trusted store of value. It has circulating among humans for tens of thousands of years. So it’s safe to say it has saturated the market. Bitcoin hasn’t yet saturated the market, so its upside potential is at least 100x from here.

Solid advice.

Goverments can make owning bitcoin a prosecutable offense. But even in that worst case scenario you’ll be able to cash it on the black market.

Correct, in this scenario Bitcoin’s price would crash, but it wouldn’t fall to zero, because it’s still legal in other nations. The nation that makes Bitcoin illegal to own would only be placing their own people at a disadvantage. The price would continue its upward trend in the rest of the world.

From what I’ve seen of Bitcoin, it is a not only a scam in itself – a faux-“currency” that is nothing but imaginary pixels, 1s and 0s, stored on a computer somewhere that is not actually legal tender, and essentially investing in it is no different than investing in a pyramid scheme – but it is also a haven for scammers and criminals of various sorts. Starting in September 2018 until now, I have been inundated with upwards of 20 blackmail attempts per day from people using Bitcoin accounts to claim they’ve hacked me and will release secret info unless I pay them in Bitcoin, and there seems to be no way to stop it (short of discarding the email address I’ve had for 15 years). Google “Bitcoin sextortion scam” or “Bitcoin blackmail scam” and you will see exactly the kind of thing I am talking about. They were disconcerting at first, but now I know they are clearly scams and don’t even bother to report them, or waste time investigating the headers, etc. (I used to report to FBI Cybercrime division, but nothing ever seems to happen, so it became clear I was wasting my time), but it is annoying to still see a stream of them in my email every day. Bitcoin should be shutdown.

I literally laughed out loud. Scammers take dollars and euros too. Therefore, the dollar should be shut down.

I suggest looking through your email options and finding the keyword filter. You can have it automatically categorize all emails with the word “bitcoin” as spam. But the key takeaway is that scammers consider the currency valuable. If Bitcoin were a scam in and of itself, the scammers wouldn’t bother to have you send it!

Do you know what else is not legal tender? Gold, diamonds, oil, or any other commodity that holds value.

All “legal tender” means is that the currency can be used to pay public or private debts . If I owe my local state property taxes, they legally have to take US dollars in payment. It’s a central governments way of ensuring that people have to use it’s currency.

However nothing is stopping you (or anyone) from selling a valued commodity to obtain Fiat “ legal tender “ currency to pay someone that only accepts “legal tender”. I can’t pay my taxes in gold, but I can sell it to obtain the funds.

A couple of important thing that I missed.

The original bitcoin lives on in Bitcoin SV, because it follows the white paper, provides a stable protocol, and aims for massive scale.

But where it is very useful for us online dissidents, other than being the best money ever, is that you can store data on the blockchain. Immutably. Forever.

This includes pictures, text, movies, pdfs. You name it. Even entire websites can be hosted onchain. All this is in its very early stages, but it works.

See https://bitstagram.bitdb.network/ for onchain pictures

https://add.bico.media for file storage

https://bitpaste.app for texts

https://www.streamanity.com for pay-per-viewed-minute video monetization

All of this is only possible on Bitcoin SV.

Bitcoin (BTC) has segwit, which means it isnt bitcoin anymore according to the whitepaper, has 1 MB blocks which means it cant scale and causes ridiculous high fees when the blocks get full.

People should always do their own research

I’m a Bitcoin maximalist, so we are bound to disagree on this, but I think when the hard fork occurred the market consensus was that smaller blocks are better for sustainability and decentralization. When you have a massive blockchain (like with Ethereum), you end up creating an enormous barrier-to-entry for new miners and nodes, because they will eventually have to spend years syncing their copy of the blockchain. If someone can come up with a long term solution to the blockchain size problem, I’d love to see it implemented. But as it stands I can only recommend Bitcoin for investors because it’s the coin most people want to have. I don’t think that network effect is something another currency can ever overcome.

Clearly you see Bitcoin as a long-term investment to hold and not spend. What is your assessment of Bitcoin for the purpose of supporting a parallel economy, i.e. for spending instead of holding?

If you have a choice, you should spend dollars and hoard Bitcoin. Only spend Bitcoin when there’s no other convenient way to transfer money to the person. When you spend money, you are driving down its value. When you hoard money, you drive its value higher. So if you want to destroy fiat currencies, you should part with the inflationary garbage. The guy receiving the dollars can use them to buy BTC if he wants to. Once the dollar hyperinflates, people will start to demand BTC when they sell stuff.

Or, if you feel compelled to invest, you could put your money into a local company that actually makes something useful or provides a useful service.

You mention not to use Coinbase. If one has a Coinbase account and wants to “do something else” how would they go about that? Basically how does a Trezor and backups work?

You don’t have to close your Coinbase account. Just move your money off of it, and don’t use it to buy BTC anymore. You can register for an account with another exchange like Gemini or Kraken.

A Trezor is a little unhackable computer that will generate a new address for you, and you send your BTC to that address. The bitcoins themselves aren’t actually located on the Trezor, just the private keys necessary to move them. So you can make as many backup copies of those keys as you want. The format of the backups is a list of 12 seemingly random English words. So you jot that list of words down on some slips of paper with a pen. Never enter them into a computer, because they could potentially be accessed by malware. When you spend BTC from an address, the Trezor uses the private key and the transaction data to create a unique digital signature. That signature is what’s broadcast to the network, not the private key. The math involved allows other computers to verify you have the private key without actually seeing the key, or knowing what it is.

Humanity’s immemorial longing for a constant, calculable unit of value is not going to be satisfied by blockchain technology. Blockchain is brilliant transactional protocol that should continue to avail us into the future; but Bitcoin, et al, are no different that any other currencies insofar as their only value inheres in what might be exchanged for them. Progress toward an ultimate value unit will not proceed until “value” and “money” are understood as different categories.

Money is denominated in specific currencies, the values of which will always be corruptible, whether by ordinary economic activity, nefarious design, or human folly.

Computation of objective value requires nothing less than a comprehensive macroeconomic theory. The determinants of value would be the boundary conditions of such a theory, viz.: the shape of production and utility tradeoffs.

Once again, I will commend SFEcon as the requisite theory to the dissident right’s bigger brains. Their repulsion, which seems to be rooted in tangential associations with the NSDAP, would be well worth overcoming for the sake advancing an Apollonian approach to economic science in exception to the Talmudic.

Regarding multiculturalism and bitcoin, I think it is entirely appropriate that bitcoin is advertised as a multicultural money. Nationalists should happy about this because crossing boundaries is exactly what a good money is supposed to do. Each nation can have their own culture/race and still use the same money to cooperate on a global scale. For these reasons, I think the way the Bitcoin Rabbi depicts bitcoin in his “children’s” book appropriate.

BTW, the author has admitted his book is really a book for adults disguised as a child’s book. Many of the characters in the book are based on real people in the bitcoin community.

Comments are closed.

If you have a Subscriber access,

simply login first to see your comment auto-approved.

Note on comments privacy & moderation

Your email is never published nor shared.

Comments are moderated. If you don't see your comment, please be patient. If approved, it will appear here soon. Do not post your comment a second time.