To get started in Bitcoin, you need to learn a few basic skills and concepts. I’ve listed the key skills here. There are many different Bitcoin wallets and exchanges, and the best ones depend on which country you are in. So doing a comprehensive step-by-step guide for everyone would be too much. My goal here is to point you in the right direction so you can figure things out yourself, or find answers to your other questions elsewhere.

Creating an exchange account

Bitcoin exchanges are where you can buy and sell Bitcoin (BTC). Avoid Coinbase and Cash App, because they are Leftists. If you can, get an account with Gemini. They are run by libertarians who believe in freedom of speech, so they are less likely to kick White nationalists off their service. CEX is a decent exchange in the UK. For more comprehensive lists of exchanges in your country, you can ask users on Reddit, or search the Bitcoin Beginners subreddit for others who have already asked.

Once you’ve found an exchange, you’ll need to link your bank account to the exchange, similar to how you link it to PayPal. To do this you will need your account and routing numbers (the numbers on the bottom of your checkbook). This way you can send fiat currency to and from the exchange without paying wire transfer fees. They will typically want you to send a photo of your picture ID, proof of residency, etc. You will also want to create a secure password for the exchange, and I recommend using random.org for this. They have a password generator function. Some browsers will automatically create strong passwords for you, but either way, you should make sure to write the password down on a sheet of paper. It’s always good to have a physical backup of these things. Finally, you will want to use two-factor authentication (2FA) to keep your account secure. This makes it impossible for a hacker to log into your account without also being in possession of your smartphone.

Buying Bitcoin

Once your account is created and your identity has been confirmed (which may take a day or two), you can start sending fiat currency to the exchange. Choose ACH when possible, because wire transfers cost money and they are a hassle. When the fiat money appears in your exchange account, it will just sit there until you use it to buy Bitcoin. There’s no pressure to immediately buy.

When you finally decide to start buying, you should plan on buying BTC on a regular schedule. No trading. No altcoins. No timing the market. This is called “dollar-cost averaging,” and it’s the best way to avoid the psychological pressure that comes from holding a volatile asset. You’ll also end up with more BTC than if you trust your gut instinct to time the market. Just because Bitcoin “feels” cheap or expensive at any given moment doesn’t mean that it is. Markets have a way of shocking even seasoned traders.

Keeping Bitcoin

Once you’ve accumulated a significant amount of BTC in your exchange account, you will want to buy a hardware wallet to store it yourself. Leaving large amounts of BTC on an exchange for long periods of time is risky because it’s much easier for hackers to get into an exchange than for them to take BTC stored locally on your own device. Hardware wallets give you peace of mind because they are impervious to hackers even when they are connected to a PC infected with viruses. Even if the hardware wallet is broken or stolen, you can still recover your BTC. It’s possible to make written backups of the recovery seed. A recovery seed is a list of 12 (or 24) random words that, when entered into a computer or another hardware wallet, automatically recovers all your BTC and addresses. Never store a recovery seed as a digital file, only write it on paper using a pen. Store this paper in a safe location, because anyone who has it will be able to access your BTC. I recommend getting either a Ledger or a Trezor hardware wallet. You can get these on Amazon or directly from the manufacturers. Here’s a link to a video on hardware wallets and good Black Friday deals. I highly recommend subscribing to this channel and looking at his other videos, because they are a treasure trove of guides.

Software wallets are slightly less safe than hardware wallets, but they can be useful for storing small amounts of BTC that you want to use for donations or purchases. When creating a software wallet, choose the “Segwit Native” address type. All addresses are compatible with each other, but Segwit Native will reduce your transaction fees and it’s the most advanced address type. A good software wallet you can install on your phone (either iPhone or Android) is called BlueWallet. You can find it in the app store for free. Here’s a video about it.

It’s a good idea to avoid making a lot of transactions. Every transaction incurs a fee. Transactions also open you up to the possibility of making a mistake, which can cost you money. So pay close attention to the recipient address you are copying/pasting to ensure it’s the correct address. A good way to reduce your transaction fees is to make most of your transactions on weekends, because this is when there’s less network congestion. You should also use fee estimation websites to determine what a fair fee is when you make your transaction. I recommend bookmarking the website www.bitcoiner.live for this. Unless you are making an important, time-sensitive transaction, you really don’t need to have it confirmed soon. Nearly every time I make a transaction, I use the fee that ensures confirmation within 12 hours. Usually, it is confirmed within a couple of hours anyway.

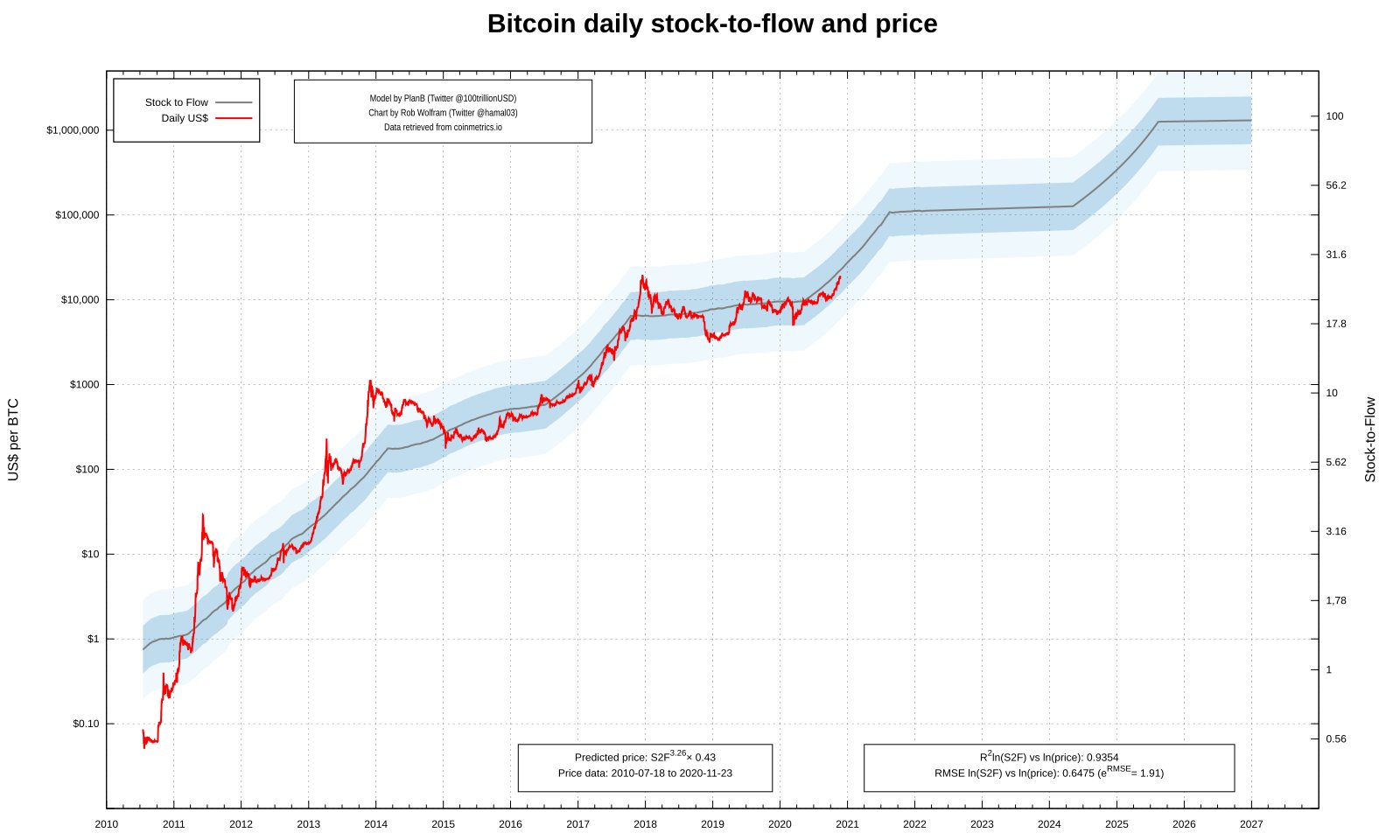

Plan to hold for at least 5 years, ideally 10. Long term prospects are important. Familiarize yourself with the investment thesis, which is based on stock-to-flow ratio:

Donating Bitcoin to nationalists

Once you have some BTC you would like to donate, there are a few ways to do it anonymously. The first is pretty straightforward — just transfer the BTC from your exchange account to another wallet you control, and later move the BTC from that wallet to the donor’s address. This creates plausible deniability because you aren’t sending the BTC directly from your exchange account to a publically known nationalist.

But if you want more anonymity than this, and the recipient has a Monero address, you can install the Exodus desktop wallet software on your PC and move some of your BTC into it. You will see an exchange button next to the send and receive buttons. Click that, and on the left side, you’ll see where you can enter the amount of BTC you’d like to swap for Monero. Then choose “Exodus” in the dropdown menu on the right side, and under that choose “XMR Monero” in the other dropdown menu. Click “Exchange.” The exchange will take a few minutes to occur, and once you’ve received the Monero, you can send those coins with a high degree of anonymity.

I recommend against investing in Monero long term. Its main use is for the transactions you want to keep very private.

It’s possible to make Bitcoin equally private, but it requires you to have at least 0.1 BTC. Once you’ve accumulated that much, install Wasabi wallet (for PC) and send your BTC to the address it generates. You can then use Wasabi to participate in a CoinJoin, which is a kind of group transaction that effectively shuffles your BTC with up to 100 other people who also have 0.1 BTC. Once they pop out the other end of the transaction, it’s impossible for an observer of the blockchain to know which 0.1 BTC are yours and which are someone else’s (as long as you keep them segregated from your other, non-CoinJoined BTC). There are videos you can find on YouTube that will guide you through these processes. Here’s a good one for Wasabi.

Receiving Bitcoin

Learn how to generate new receiving addresses and how to copy/paste them. Keep a close eye on the address when you paste it, because you want to make sure you don’t accidentally paste the wrong address or have malware on your computer that causes you to paste someone else’s address.

Keep good records of when you buy, receive, and sell Bitcoin. Usually, exchanges will send you an email whenever you buy or sell, so that’s a handy way to go back and see the exact dates and figures. Just search your email for messages from the exchange. You can use this information to keep a running “FIFO,” which is just an Excel document that helps you calculate how much tax you’ll owe when you sell. As long as you don’t sell, you won’t owe any tax. If you do sell, the rate will usually be pretty low — in the US it’s typically only 15% of the profit you made on the sale (not 15% of the full sale value!). So you shouldn’t stress about taxes unless you are being an active trader. Yet another reason to avoid trading.

I use https://bitcoinwisdom.io/markets/bitstamp/btcusd to check prices. I’ve bookmarked it on both my phone’s browser and my desktop PC. I select the “1d” time interval in the upper left, and zoom in and out using the scroll wheel on my mouse. This way each of the “candles” you see represents one day of trading activity.

All of this can seem daunting at first, but I promise it’s not tough. Use common sense, poke around software options, avoid making transactions until you are confident you know what you’re doing, and ask knowledgeable people for help if you need it. There are many great YouTube channels that provide tutorials for using various Bitcoin software and hardware wallets, some of which I have linked in this article. Ignore people who send you messages saying you can “invest your crypto” or “earn interest on your BTC” — these are common scams. The key to success in Bitcoin is inactivity. Other than accumulating BTC over time as a long term investment (and the occasional donation to nationalist causes), you should just sit back and be patient. Trying to make a quick buck in other coins or by trading almost always ends badly. Be sure to read my first article on Bitcoin, published on Counter-Currents early last year. It’s still very relevant today!

Finally, I would like to plug my Telegram channel for anyone who would like to join and see my updates and analysis on Bitcoin. I post daily, and comments are open so you can ask questions.

If you want to support Counter-Currents, please send us a donation by going to our Entropy page and selecting “send paid chat.” Entropy allows you to donate any amount from $3 and up. All comments will be read and discussed in the next episode of Counter-Currents Radio, which airs every weekend on DLive.

Don’t forget to sign up for the twice-monthly email Counter-Currents Newsletter for exclusive content, offers, and news.

Enjoyed this article?

Be the first to leave a tip in the jar!

Related

-

Counter-Currents Radio Podcast No. 582: When Did You First Notice the Problems of Multiculturalism?

-

Counter-Currents Radio Podcast No. 565: The New Year’s Eve-Eve Special

-

Counter-Currents Radio Podcast No. 561: An All-Star Thanksgiving Weekend Special

-

Counter-Currents Radio Podcast No. 560: Is Elon Musk the New Henry Ford?

-

Counter-Currents Radio Podcast No. 558: Has Jewish Power Peaked?

-

An Investment Option for Dissidents

-

Sex, Privacy, and Data Protection

-

Counter-Currents Radio Podcast No. 528 Karl Thorburn on the Bank Crashes

17 comments

Is there any particular reason to prefer Bitcoin over other cryptocurrencies?

There are a few reasons to prefer it for long term investment:

1. Biggest network effect (money benefits from this in the same way social media companies do)

2. Highest network hash rate (this makes it extremely difficult for hackers/govts to attack)

3. Deepest liquidity. Liquidity just means the price isn’t as easy to push around. It takes much more effort for traders to game the market. So that attracts bigger pools of capital that don’t want to invest in something tiny and easily manipulated.

Have a look at today’s “1d” time interval.

Look at my last Counter-Currents article. It was published early last year. At the time, Bitcoin was only $8300 or so, and there were many skeptics in the comments. The price has more than doubled since then. Pretty good return, if you can stomach the swings!

I took your advice. It was good advice. Thanks.

Yeah, what is the zoology of the crypto currencies? What is the best of the rest, etc.?

Really the only crypto that look worthwhile to me are Bitcoin and Monero. Bitcoin is best for long term investment and it’s what 90% of your crypto portfolio should be. Use Monero for transactions that you want to keep very private. Ethereum, Chainlink, Ripple, etc. are all mainly used by short term traders to turn a quick profit.

The Random site has the following intriguing info : “computer programs are pseudo-random. RANDOM.ORG offers true random numbers . . . The randomness comes from atmospheric noise.” What will they think of next?

For strong passwords that you don’t have to write down why not try this ?

Here’s a sample ” IitεaJitS ” .

Pretty strong, no? Simply take the initial letters of a fave quote (and replace one or two letters with a numeral or Greek equivalent). In this case ” It is the east and Juliet is the Sun “.

I am not against BTC if you want to speculate. But you should know one thing before you start: BTC is a zero sum game. Your gains come at the expense of somebody else. And you can only hope that it is not you who is the patsy.

For me, I rather build an income stream based on reciprocity. Integrate myself in the local economy.

However I DO support BTC as a payment system.

Disclosure: I own about 0.01 bitcoin

You’re correct, it is a zero sum game (unlike a business which actually produces goods/services). Bitcoin rewards those who hold it by reducing the relative purchasing power of those who hold fiat currency. Thiers’ Law in action.

But does it function more like a currency or like a commodity? Relatively few people use bitcoin as a medium of exchange, correct? (Unless there are a lot of black market things I don’t know about.;-)) still it seems that would be relatively minute to the world economy. So rather than inflating fiat currency, perhaps bitcoin behaves more like gold or similar commodity. A commodity with no practical application. But it’s value then comes from its expected spending power, which would deteriorate suddenly if as people tried to liquidate.

Bitcoin competes with all stores of value, including gold, silver, fiat currency, bonds, stocks, real estate, collectibles, art, etc. It won’t become a common medium of exchange until it has already seized a large percentage of global capital. It’s still in its rapid growth phase, so the incentive to spend it is low. So you can think of it as a cyclical commodity that’s constantly adding to its base of demand. For every one person who decides to start accumulating BTC rather than gold/fiat, that’s one less person who contributes to demand for those other assets. And because Bitcoin is more scarce than gold, the base demand for it will continue to grow until it has “stolen” the vast majority of the capital from those other asset classes. What we are seeing play out is hyperDEflation, where the masses gradually build more and more faith in a new currency.

To start, I have to say this entire essay is way, way above my skill set, and I have really no idea exactly what you’re talking about. On the other hand, I realize I’ve stumbled upon a genius sitting atop a goldmine of information, which a good many of Counter Currents’ readers can understand, and thus use to great advantage. Myself, I’ve never gotten above the “Work Hard, Save Your Money” aspect of Capitalism, and the ‘dabbling in day-trading aspect of investing (and I’ve made money and lost some, but thankfully made more than lost). However, I’ve managed to retire in comfort, if not wealth.

But here, I am glimpsing ways now that may be the answer to our Nationalist dreams of our own Homeland — since there is little power available to us — other than a water-tight philosophical base, written out in skillful detail by our pantheon of idealistic philosophers here. Without money, there is no power. Bitcoin may, therefore be the answer. And this essay may be the foundation of empire, though I’m well aware that many of our readers are scornful of ’empire’ building, and even I desire only “A nice White country”.

I have so many questions to ask of the writer, but first I must ask if you would be willing to be our ‘guru’ in the Bitcoin Education arena for our readers — and you seem to have a following and a bundle of critical folks already answering you. Each of us need to become a good deal more financially savvy and secure. I have pensions, though I’m fairly sure 90% of our readers do not.

First question — you have said Bitcoin will replace gold. I have faith in the intrinsic value of gold, especially in its thousands of years of association within the White race, and elsewhere. I am thinking especially of its ‘value in the hand’ of getting you across dangerous borders in time of war, if nothing else So, that’s a big topic for the future.

I’ll read up on Bitcoin, in as much detail as I can absorb, before asking more questions. But I thank you heartily for opening this viewpoint for me and others here, who see themselves as penniless philosophical wanderers, yet our whole foundation in Nationalism is “Our Own Land”. I think Bitcoin may be a great bridge.

Thank you very much for your kind words! To be clear, I don’t think Bitcoin will completely replace gold. Obviously gold will still exist long after the internet and humanity are gone. But I suspect Bitcoin will last 100+ years before it is either replaced or destroyed, because the way the network is designed is extremely resilient. It can survive a lot of attacks, and the incentive to replace it is low as long as it continues to function as it has for over a decade. As long as Bitcoin exists, it will continue to pull in capital from other asset classes due to its extreme scarcity. No matter how high the price climbs, miners can’t create more BTC than the network allows. This sets it apart from gold, which can be (and is!) mined in larger and larger quantities as the price surges.

One powerful feature Bitcoin has that gold doesn’t is that you can memorize your wallet recovery seed. As long as you know those 12 words, you can pass through checkpoints and borders with millions of dollars in your head. Nobody can detect or confiscate that. When you arrive at your destination, you just enter the seed into a hardware wallet or PC and you instantly have access to all your BTC. The device uses the seed to mathematically reconstruct all of your private keys, then it scans the blockchain to find all of your addresses and coins. This is completely automatic. Pretty clever!

I know Bitcoin isn’t for everyone. But for those who are open to understanding it, I think the potential for profit is enormous over the next 5 to 10 years.

Thanks for this info.

This will sound stupid but the thing I still don’t get is how is it protected from being ‘turned off’?

Also could you please list your favorite youtube/bitchute channels to learn more. That is my preferred way to learn.

I am using for now Coinbase, which seems to have an easier user interface. I have tried others as binance but there is too much clutter and login and verification process are annoying. Revolut on the other hand has no alternative crypto currencies available which is bad. Anyone willing to have a portfolio with Bitcoin, Ethereum and alternative coins, could have a look in Coinbase to figure if suits you. Here’s the invite: https://www.coinbase.com/join/junior_n2c

Interesting article and will try to follow more. I installed Telegram but it says that there is no account associated with you when I click the link listed in yr article.

Do you have an email or can I get yours from contacting Greg?

” title=”

“>

Comments are closed.

If you have Paywall access,

simply login first to see your comment auto-approved.

Note on comments privacy & moderation

Your email is never published nor shared.

Comments are moderated. If you don't see your comment, please be patient. If approved, it will appear here soon. Do not post your comment a second time.

Paywall Access

Lost your password?Edit your comment