The following, which was originally published at Counter-Currents in 2019, is being reprinted now as it continues to be relevant. Interested readers should also see “Bitcoin Basics.”

I should preface this by saying I’m not a licensed investment advisor. Only risk what you are willing to lose. That goes for any investment, whether it’s government bonds or expired yogurt. Bitcoin is one subject that causes a lot of disagreement. Many people think it’s a scam. It’s often cited jokingly as the cause of someone’s wealth, or their poverty. It has been around for more than a decade, and yet many people still file it away in their minds as “that newfangled thing that’s a bubble that will fall to zero any day now.” The whole concept seems pretty bizarre and unnecessary if you aren’t a geek for monetary theory.

But if you take the time to learn about the history of money, and why certain things become very valuable despite being mostly useless, then Bitcoin makes a lot of sense. I’ve tried to condense my most worthwhile ideas here because I want to influence a few fellow White Nationalists to take a stake in it. As it stands, most of us are aware it’s a good medium to bypass PayPal and banks to support fellow nationalists we care about. The fact it can’t be frozen or confiscated is a blessing for all dissident thinkers. But there’s much more to it.

1. It’s worth investing in. It isn’t a currency so much as it is a cyclical commodity that’s still in the process of filling out. It is a convex, non-correlated, bearer asset, that isn’t yet available via traditional brokerage and custodial firms. That means buying it now gives you a huge leg up on multi-trillion dollar pools of capital that want exposure to this commodity, but can’t yet get it. Hedge funds and family offices love non-correlated assets because they provide potentially good returns when the stock market is down.

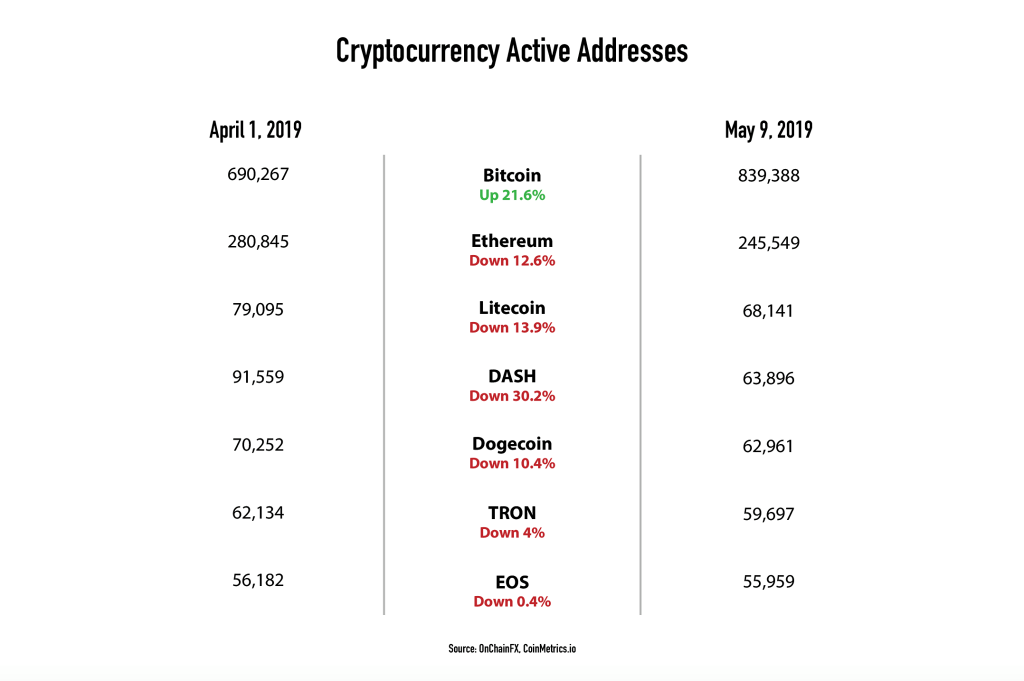

2. Don’t buy other cryptocurrencies. Bitcoin’s network effect and liquidity advantage make it insurmountable within its class. Alt-coins come and go. Bitcoin will remain on top.

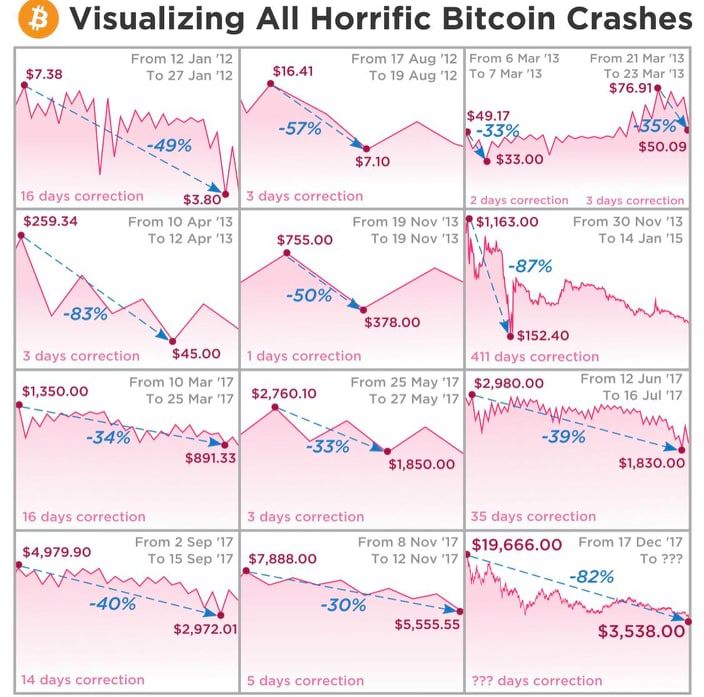

3. Hold it long term. It’s best to think of owning Bitcoin like owning shares of Microsoft before the PC craze really took off in the ’90s. It will have periods of huge gains, and periods of gut-wrenching crashes. But if you can hold for 10 or more years, you will likely benefit enormously.

4. Avoid trading it. Trading any crypto means recording every buy and sell order you make, and calculating the profit/loss on each one. It’s a huge pain, and the vast majority of traders end up losing money. The buy and hold strategy is much better.

5. Don’t fall for scams or the “blockchain technology” mumbo jumbo. There are thousands of people in the cryptocurrency sphere who try to get people to invest in their business ideas and tokens. Don’t get sidetracked. You only want Bitcoin.

6. Bitcoin’s growth phase will likely last another 15 to 20 years. There is a good chance it will destroy several fiat currencies along the way. Nobody knows for sure how the market will react to its rise – it might become a large commodity like gold, or it might supplant government money and be used in day to day transactions. Bitcoin maximalists like Pierre Rochard theorize it may create a springboard from which speculative attacks can be launched against fiat currencies, wherein traders borrow fiat in order to buy BTC. This drives down the value of fiat, while driving up the price of BTC. The cycle continues until the fiat hyperinflates. A similar process was used by George Soros when he attacked the British Pound.

7. The high volatility of Bitcoin doesn’t matter. In fact, it’s a good thing. People who complain about the dramatic price swings lack teeth and can only eat applesauce. If you want stability in your investments, then you are in the extreme minority. Most people want to own things that go up in value, not sideways. While it’s true that Bitcoin crashes every so often, each crash lands at a far higher level than the previous crash, due to the massive influx of new people accumulating and hoarding the digital commodity in anticipation of the next bubble cycle. You can’t have a smooth, steady climb from zero to a multi-trillion dollar commodity. Markets just don’t work like that. There are manias and depressions along the way. The volatility is a symbol of life, vitality, youth. It attracts traders, which provide added liquidity to the market. It also generates headlines, which ensures Bitcoin will be in front of many more potential buyers.

8. Bitcoin is a bet on globalism. That’s not to say it helps globalists, however. It severely limits their ability to track and control the flow of capital, which means sanctions and censorship become much harder. But if you are a nationalist, and you want to be well-hedged, it makes sense to own a commodity that facilitates global trade. Make the bad guys work for you.

You can buy Greg Johnson’s The White Nationalist Manifesto here

9. Bitcoin is not totally anonymous (unless you jump through some hoops, and you’re technically savvy). So don’t expect full privacy.

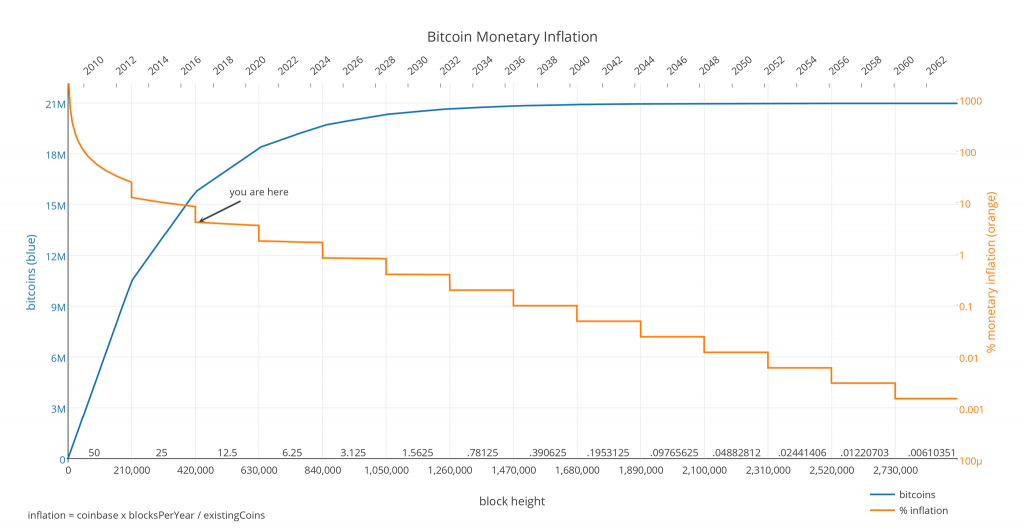

10. It’s a store of value. This is the most important thing to understand. The key to Bitcoin’s success is simple: the 21 million coin limit. Forget about anonymity, the dark web, blockchain technology, etc. Those other things are secondary. For the first time in human history, we have a commodity with a mathematically limited supply and a predictable mining schedule. That makes it the best store of value that has ever been available to investors. I recommend the book The Bitcoin Standard by Saifedean Ammous for a good explanation of the history of money and why Bitcoin is the best money-like token that has ever existed. Even gold has a higher rate of supply-increase than Bitcoin. When the value of gold climbs, miners are incentivized to dig up more of it. Thus, the rate of supply-increase climbs, which then tempers the price by flooding the market with more gold. This same effect can’t happen with Bitcoin. As the price of Bitcoin rises, the network adjusts mining difficulty higher to avoid flooding the market with extra coins. So the supply increase occurs exactly as scheduled. An analogous situation for gold would be if the metal magically buried itself deeper in the ground the higher its price went. And we somehow magically knew there were exactly 21 million kilograms of gold, no more or less.

11. The Average Joe doesn’t need to own any Bitcoin for it to become extremely valuable. Average people are among the last to own any worthwhile investment. All it takes are a few billionaires and a couple hedge funds to bid up the price of Bitcoin into the stratosphere.

12. The Bitcoin network can only process around 7 transactions per second, compared to Visa and Mastercard which can process more than 10,000 transactions per second. But the rate of transactions and retail purchases don’t matter, for a couple of reasons. The first is that Bitcoin’s value comes from the fact it is impervious to inflation and censorship, not because you can buy Starbucks with it. The second is that the blockchain, while severely limited, is more than sufficient as a global “base layer” for settlements. Second layer solutions such as the Lightning network are currently being built that will make it possible to send and receive even more transactions than credit card companies can handle, and with greater privacy.

13. Avoid Coinbase. They ban people for political dissent.

14. Not your keys? Not your coins. Don’t trust someone else to store your BTC for you. I recommend storing them on a Trezor, or learning how to create a secure offline wallet.

15. Have backups of your wallet. Hide them in various locations so you can have peace of mind that you’ll still have access to your money even if your house burns down.

16. Immediately after you buy BTC the price will fall. It’s like a law of nature, so just accept it. But when Bitcoin goes up, it tends to go up very quickly.

17. When you sell (in 10+ years), keep records and pay your taxes. The government already hates nationalists and white people, so don’t give them an excuse to harass you.

18. The bad guys are eventually going to want to own it. We are already starting to see some Wall Street players and Israeli businessmen pushing Bitcoin hard, trying to get their fellow tribesmen on board. There’s even a self-styled “Bitcoin Rabbi” on Twitter who has written a children’s book on the subject. Predictably it features a white girl with a black boy on the front cover. On the other hand, several prominent Jews have come out swinging against Bitcoin, including congressman Brad Sherman who recently said he wants to ban it because of its potential to overtake the dollar in global trade. Joseph Stiglitz, a Left-wing Jewish economist, just said “we should shut down the cryptocurrencies.” Nouriel Roubini called it “the mother and father of all bubbles.”

If governments could shut it down, they would have done so several years ago. Over time these people will come around and begin accumulating. Then they’ll start to publicly advocate for it. It’s inevitable. But before that happens, White Nationalists should already be well positioned. This is a race, and it would be a shame if we missed out on an opportunity to become financially independent (in more ways than one). Bitcoin offers us the opportunity to have money to start our own businesses, support each other, and speak our minds publicly without fear of being shut out of the economy. The first step in that journey is to start hoarding like Smaug.

* * *

Counter-Currents has extended special privileges to those who donate $120 or more per year.

- First, donor comments will appear immediately instead of waiting in a moderation queue. (People who abuse this privilege will lose it.)

- Second, donors will have immediate access to all Counter-Currents posts. Non-donors will find that one post a day, five posts a week will be behind a “paywall” and will be available to the general public after 30 days.

To get full access to all content behind the paywall, sign up here:

Paywall Gift Subscriptions

If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

- your payment

- the recipient’s name

- the recipient’s email address

- your name

- your email address

To register, just fill out this form and we will walk you through the payment and registration process. There are a number of different payment options.

What%20White%20Nationalists%20Should%20Know%20About%20Bitcoin

Share

Enjoyed this article?

Be the first to leave a tip in the jar!

Related

-

Counter-Currents Radio Podcast No. 582: When Did You First Notice the Problems of Multiculturalism?

-

What Future for the Polish Right and for Democracy? An Interview with Andrzej Nowak

-

Right-Wing Alternative Media or Right-Wing Hobbyism? Streaming for Hearts and Minds

-

The New European Union and Its Superstructure

-

The National Justice Party: A Postmortem

-

Counter-Currents Radio Podcast No. 565: The New Year’s Eve-Eve Special

-

Islamic Russia

-

Polish-Style Territorial Defense Could Be the Answer to the Risk of Civil War in France

21 comments

Thanks for reprinting this. I can’t remember having read it—some parts seem to be new.

There is something I’ve been intending to ask thorburn about. Recently, in Peyton Gendron’s manifesto, he had a section on crypto, which he was strongly against, in contradistinction to most on the dissident right. Well, he linked to an interesting article from Jacobin, a socialist webzine, on the topic of crypto. I wish Karl would read and comment upon it. Basically they claim that Bitcoin has become a Ponzi scheme in the sense that the price is being floated by stablecoins, crypto currencies nominally pegged to the dollar, and backed by the dollar. But they are not really backed by dollars and have only paltry dollar reserves. So say, it’s like a gigantic quantitative easing for Bitcoin. Like the federal reserve, they are creating huge amounts of “dollars” and then buying Bitcoin, similar to the fed creating dollars and floating the markets. They argue cogently seemingly that Ponzi schemes can go on for some time—madoff went on for seventeen years.

There’s actually some truth to the claim that Bitcoin’s price is (was?) being helped by these “stablecoins”, but only to the degree that they added liquidity to the market. If you look at who’s actually using stablecoins frequently, it is primarily active traders who mostly participate in altcoin trading. These people also use Bitcoin as collateral for leverage in their portfolios, so when their altcoin trades go south, they are forced to liquidate their Bitcoin holdings (which drives down the value of Bitcoin). Basically Bitcoin is both helped and hurt by these complex and layered financial tools being implemented by degenerate traders. Futures contracts pull capital away from Bitcoin, altcoins attract newbie money away from Bitcoin, NFTs, etc. An entire ecosystem of garbage has been built up around Bitcoin, which is a terrible shame because it causes people to mistake Bitcoin for “just another ponzi scheme like all the others”. Longer term these things won’t matter much, because investors will gradually become more educated and aware that most altcoins are not worth investing in, and the heavily-leveraged traders will be bankrupted out of the market. There will always be some degree of degenerate traders in any market, so the crypto market isn’t fundamentally different from the traditional markets, aside from the bigger price swings. But the idea Bitcoin’s exchange rate only rises due to the creation of stablecoin dollars is nonsense – those dollars would’ve found their way into the market one way or another, even without stablecoins. And Bitcoin’s price *mostly* rises due to a lack of supply (hoarding), rather than sudden spikes in demand.

Karl, why do you think that altcoin is not worth investing in? Altcoin has much more volatility than BTC, but so does BTC compared to bank deposit interests, and altcoin is much cheaper now. And altcoin is mathematically limited to 21mln (or whatever) just as well.

I think that many altcoins will bite the dust, but chances are that a few selected ones will catch on.

Some altcoins are limited supply, others (the most popular ones like Ethereum) have variable supplies that are subject to the whims of the developers. Their unpredictable supply schedule and relatively centralized nodes are what makes them less than ideal as stores of value. Altcoins that don’t utilize proof-of-work to validate their blockchains are basically worthless, because they are easily gamed and can be censored/shut down by governments. Bitcoin already solved the “digital scarcity” problem long before altcoins came into existence, so they aren’t really adding anything of value, and they can never catch up to Bitcoin’s adoption and liquidity. Take a look at your favorite altcoins as measured in BTC, and you’ll see they all fall against Bitcoin given enough time. Ethereum is the most recent example of a mainstream altcoin losing ground to BTC – at the peak of this cycle, it was never able to achieve the heights it claimed way back in 2017.

Note that your chart at the end of item #10 appears to be from 2016 or 2017. It should be updated to show that approx 95% of all bitcoins have been made. There will be a few more btc made but at this point we can consider the supply as essentially fixed.

Do we know who owns the bitcoins? This might provide some insights as to what the market will do. From their correlation to the downturn in the US stock market, it appears that btc are held as possibly leveraged accounts by funds with also trade in stocks?

Coins are tricky investments. I was almost cheated into buying a large coin yesterday but after a little research, I ascertained that it was a copy of the famous Anabaptist doppletaler, but made in the 1640’s.

Thanks for an excellent article and the update from your earlier post. A dabbler in crypto myself, it still good to remember there’s still many things we don’t know.

Before I got involved I read a lot. These three articles influenced me to be patient and careful in any and all transactions. They may seem like “conspiracy” stuff but, as they point out, there are some good reasons to believe the state might be behind some of this.

Whether true or not, I caution new users to go slow.

https://globalintelhub.com/nsa-create-bitcoin-classified/

https://globalintelhub.com/exposed-real-creator-bitcoin-nsa/

https://medium.com/@collapsesurvivor/bitcoin-founder-satoshi-nakamoto-was-probably-an-nsa-employee-and-the-nsa-may-destroy-bitcoin-2767c5c865c5

wow, thanks for the links. It seems you need some sort of membership for the first two.

I find it strange no one has figured out who or what satoshi is. That seems like the grand mystery of the early 21st century.

I’m working on my master’s in finance. The following is an excerpt from one of my assignments:

“As previously noted, loose monetary conditions bolster speculators; monetary tightening sobers them. Less alluring are businesses with profits deferred to some distant, albeit indefinable, future date. BTC price isn’t predicated on fundamentals or utility but narrative, and the narrative is collapsing and poised to collapse still further. What is the narrative? They are legion. “Bitcoin is a medium of exchange.” “Bitcoin is a store of value.” “Bitcoin is an inflation hedge.” “Bitcoin is a non-correlated asset.” “Bitcoin is digital gold.” “Bitcoin is the most important asset in the 21st century.” Etc. To problematize just one, consider what inflation would be if priced not in USD but BTC. It would be north of 70%!

My prediction is that BTC will continue to sell off as long as the Fed raises rates, which will easily extend into 2023. Also, I believe that there is some price threshold beyond which crypto business will begin to fail. (We’re already seeing the first signs of this as Coinbase et al. announce that they are no longer expanding their labor force.) I believe that the mania in crypto-land is such that many business models are predicated on the proposition that BTC will only go up, that is, they cannot withstand a dramatic price decline, let alone the dynamics of a bank run. And when some crypto banks and exchanges fail, custodial assets will be claimed by creditors, much to the outrage of depositors, which will catalyze a regulatory response. This concatenation of events will combine with the downward pressure of rate hikes to depress BTC further. I mean, it could be the advent of the eschaton—for Bitcoiners. Doubtless, there were many people who bought—who invested their life savings—when BTC was at an all-time high.”

Clearly, I am more bearish on BTC than is Thorburn, though I am agnostic as to its long-term success. I don’t know how to assess the probability of its success, nor does anyone else.

I would also add that previous BTC bear markets are not analogous to the current one: BTC has only existed in an extremely accommodative monetary landscape, which disproportionately benefits speculative assets. In addition to rate hikes, the Fed is beginning to let Treasuries and MBS roll off of its balance sheet, which will put further downward pressure on speculative assets, such as BTC.

If anyone is interested in how monetary policy affects asset valuations, here is more from my assignment:

“Thiel’s genius notwithstanding, the flaw in this valuation methodology is that the future is uncertain, and the future growth of tech companies is uncertainty squared. It’s a problem of epistemology: How do you know the growth will materialize? How do you know the company will have a competitive advantage? How do you know the underlying technology will succeed? Or be mass adopted? Quickly obsoleted? These are unknown unknowns. Yet one must apportion one’s bets in proportion to the probability of their success.

Recall, that monetary policy disproportionately impacts tech/growth stocks in several ways. First, by lowering the discount rate. Second, by causing investors who would prefer to hold safer assets, such as Treasuries, to “reach for yield,” i.e., hold more speculative assets (Bernanke, 2021). Third, by lowering the cost of capital, thereby increasing leverage in equity markets, which… Fourth, causes prices to rise, causing more speculators to buy, which causes prices to rise, etc.; and this positive feedback loop can give rise to market mania, which invariably crashes (Shiller, 2015). Boom then bust.”

I would strongly disagree with you that Bitcoin’s price is entirely narrative driven. If that were the case, it would have already gone to zero years ago. You have to ask yourself why people buy Bitcoin after it has crashed 70% or more from its previous all time high. Why is each crash landing at a higher level than the last? And why are more market participants jumping in each time? If Bitcoin is a fad, then we could just as easily define the Internet itself as a fad.

The fundamentals of Bitcoin are simple: the 21 million coin cap, the network hash rate, the market depth/liquidity, the adoption/acceptance by individuals and businesses, the global awareness of its existence, etc. It’s true that government raising their interest rates will attract capital away from speculative assets back into fiat currency, but keep in mind that Bitcoin has existed for 13 years now – during which time interest rates had been much higher than they are today. Bitcoin has thrived and grown during a lengthy period of Fed rate hikes before, and it will do so again. Reason being: Bitcoin’s implied rate of interest is far higher than whatever rate the Fed can muster for the dollar. The *average* rate of return for Bitcoin is around 200% per year. Could the Fed crank up interest rates for the dollar to 200%? If they could, they might have some hope of saving their currency from Bitcoin’s gravitational pull. But I seriously doubt it.

I think BTC is narrative-driven in the same way that GME or AMC is narrative-driven. Actually, I think the phenomenon of meme stocks epitomizes the speculative mania that loose monetary policy incentivizes. Robert Shiller has a good book on this called Narrative Economics. Another good read is John Cassidy’s book on the dot-com bubble, Dot-Con, which covers how traditional valuation methods are ignored when markets begin to froth. In many ways, I think the dot-com bubble is analogous to our current moment. I think that much of Web3 land will evaporate as did the unprofitable ventures of the late 90s.

What price do you think BTC will fall to in this bear market? And what probability do you assign to that?

Of course, by definition Bitcoin is narrative driven. It has no intrinsic utility. (Perhaps even negative utility if you consider the electricity it wastes!) There’s no objective reason why Bitcoin is worth more than other cryptos. The question is, how far will it’s narrative take us?

Claiming Bitcoin has no intrinsic utility is just outright false. Its utility is as a store of value and permissionless (read: uncensorable) medium of exchange. You may not *like* Bitcoin, but your personal preference for fiat currency doesn’t mean Bitcoin has no intrinsic utility.

Well, it has no intrinsic utility other than as a medium of exchange. There’s no other use for it, like say gold or salt. I don’t see how it can be a store of value without that. It’s value is narrative based.

GME and AMC are fundamentally different from Bitcoin in that the businesses can issue more shares anytime they choose, thus diluting the value of the shares outstanding. There is no hard limit to the number of shares these businesses can issue, just like fiat currency has no hard limit. It’s impossible to know the bottom of the bear market, but based on previous Bitcoin bear markets $12,000 is not out of the question. It’s also possible we have already seen the bottom. Timing the market is a fool’s errand, as I said in the article. The best policy is to accumulate for the long term.

Karl, how would you a define store of value? And would you concede that in 2022, USD has performed better as a store of value? To my way of thinking, a store of value wouldn’t have such wild price gyrations, gains or losses. I think the “store of value” narrative was a substitute for the medium of exchange narrative once it was clear the latter was untrue. It’s also used, in my opinion, to distract from the speculative nature of BTC. It also obscures the reason people buy BTC. Ask yourself, am I buying BTC to keep pace with inflation? Or am I buying it because I think it’s going to $1,000,000? If the latter, it’s for speculation.

And the analogy I was drawing between GME and BTC was that they are both narrative-driven, unlike, say, Marathon Petroleum stock: its price is a function of the economic reality of the company. The former are speculative; the latter is justified by the company’s dividend, tangible assets, etc.

Thank you for this interesting article. I own no crypto/BTC because I don’t put money into things I don’t understand, and I really don’t understand crypto/BTC theory. I’ve seen Ammous featured at the Mises Institute website, however, so I think I’ll purchase his book on the subject (esp as it comes with a laudatory rec from Joseph Salerno, an Austro-libertarian economist I respect).

My ignorance confessed, I’m skeptical of crypto/BTC. Gold (esp held physically) strikes me as a safer bet, if only because it’s tangible and has real value (apart from its minimal industrial and dental uses and component of central bank holdings, at least insofar as people have always valued gold aesthetically). Even gold, however, should not be the main (or even a very large) holding of an average investor.

Unless you believe in a “Mad Max” scenario (total apocalypse) – in which case you should be “investing” in objects that serve to sustain and defend life {guns, ammo, MREs, seeds, water purifiers, first aid, good boots and durable clothes, etc} – the purpose of investing is to earn money on your money, esp when real interest rates are negative, as they have been for so long in the US (meaning that merely keeping money in the bank is a way to lose wealth over time –> an appalling indictment of our modern “political economy”, please note). Historically, the best way for most people to accomplish this is to invest in businesses which produce products/services and thus income, doing so either directly, or indirectly (via stocks). If I buy a share of Apple, I know what I’m getting a piece of. Apple, Exxon, P&G, etc, produce actual things, things which sustain actual life, or which people consistently find desirable, and thus these companies have inherent value (whether that value is over/underestimated at any given point is always the main question). Farmland has inherent value. Real estate has value. Guns have value.

What is the inherent value of BTC? What does it do? What is the ‘good’ it provides?

And what is the protection that BTC can offer against some kind of state predation? Governments can intern and murder people, ruin businesses, and confiscate wealth, including gold. Of course, they could also interfere with crypto. Unless I’m very much mistaken (and perhaps I am), it seems that our government could regulatorily destroy the crypto markets (and thus BTC value) far easier than it could actually seize gold, let alone socialize companies or murder civilians. What are the relative probabilities?

“What is the inherent value of BTC? What does it do? What is the ‘good’ it provides?”

Bitcoin provides scarcity. For the first time in human history, we have access to real, mathematically enforced scarcity. Metals, real estate, fiat currencies, etc are not truly scarce, because time and effort can be spent to produce more units. Underestimating the value of scarcity is ultimately why so many people missed the boat on Bitcoin (and will continue to miss the boat as it rises beyond $100k, and eventually $1M). Most people are only interested in flashy stuff like cheap transactions, instant settlement, “smart contracts”, anonymity, etc. But that flashy stuff is easy to implement. Scarcity isn’t. What Satoshi created with Bitcoin was a far bigger deal than what Musk and Thiel created with PayPal.

I agree with Lord Shang, though I am up in years, and Bitcoin is essentially beyond my worn-out White IQ, I guess. I have some gold coins I’ve accumulated over the past 13 years, and I sell one or two a year now, to pawnbrokers. Be aware that you never get the ‘spot price’ of the day or hour when selling gold, plus you get a ‘poor me’ song and dance from the shopkeeper. I’ve gotten $1750 for 1 0z. of gold on a day its spot is $1850. I have no idea whatsoever how to buy or sell a bitcoin. I’ve decided to sell gold more gold more quickly due to health concerns which might land me in a care-home on welfare eventually. Everyone has different needs. Bitcoins seem like something only for the young, because you will have time in life to ‘start over’ if this ‘sure thing’ proves not to be. I’ve had to ‘start over’ about three times in life after losing everything in real estate and in the stock market (in 1999-2001). So, now it’s cold hard cash for me. And the way to ‘offshore’ it is to hide it in a waterproof, fireproof place that only you know about. If you have children, put cash into a legal trust fund for them. I’ve had a small trust fund from my uncle for nearly 30 years now. They’re the best. But again — for the young, Bitcoin sounds like a great idea! And don’t forget to tithe to Counter Currents for giving writers and educators like Karl Thorburn a platform.

Thanks for a fine article Karl.

I agree with you in regards investing in Bitcoin. If you’re going to invest in crypto, Bitcoin should be your number one in your portfolio, regardless of its price. I do disagree with you on the altcoins. Is Ether an altcoin? Many now call Ether, along with coins/tokens such as, Solana, VeChain, Binance Coin, blue chip crypto. I tend to agree. Since it’s reported that over 85% of all ‘altcoins’, are built on the Ethereum network, I think it is pretty safe to say that Ethereum will be around for a very long time and is a pretty safe investment. One just has to be able to accept crypto’s volatility.

I also feel that there is a place for even some of the meme coins; they are like the McDonald’s of crypto but even better. A novice can buy millions of them for a few dollars and learn about crypto. They can stake them, trade them, send them to their friends, use them now at many stores around the world who accept them etc… Meme coins like Shiba Inu and Doge coins are becoming ‘recognized brands’. Most alt, meme coins will probably disappear over time. But some will remain and like Bitcoin, become part of everyday finance.

For anyone interested, the Metaverse is definitely worth exploring as an investment. Platforms like Earth2, Next Earth, ShibaVerse, there are a bunch out there, are very, very interesting. Like crypto currencies, it is starting to look like the Metaverse, like it, or not, is going to become a very big part of our lives.

In response to the above comments I’ll refer back to a diversified investment portfolio. Select crypto currencies can be a good part of one. In the event of a US dollar collapse they could prove quite valuable. On the other hand if the Stock Market crashes liquid assets will prove invaluable to gobble up big chunks of that market. It seems as if people are still on the fence about crypto as if it’ll disappear, but it has its own uses though not always apparent. Now crypto is a viable way to move money in and out of Russia. I haven’t had to move money between my American and Russian bank yet but this is one way I can accomplish that. With the current fracturing of the global economy it’ll only become more useful. Russia, China and India are all pulling away from Western financial institutions. They’re tired of being financially screwed in the rear by America and its butt buddies. Global financial markets are full of shenanigans and schemers. We must protect ourselves financially. Crypto is simply one of many ways to do that. We should hold a little of everything worth owning and get those returns. I’m not a financial advisor, but the concept of a diversified portfolio comes from the aforementioned Robert Schiller, who is quite intelligent in regards to finance. Now is the best time to get financial literacy. I wish I had started down my own financial literacy path earlier.

One final comment — your best investment in life is at least a bachelor’s degree in Finance and then a J.D. in Law. You can always find a well-paying job in those two fields, though it might not be to your liking as a young person. Just do it. You can always take evening courses in Art History, Literature, European Culture, etc. — the loves of my life, and maybe yours as well as White Nationalists. Get yourself situated on a higher rung in life at the onset, and opportunities will present themselves right along. Best of everything. Oh, and be sure to travel all over Europe to see where you are really from. America is second place in my opinion. Enjoy!

Comments are closed.

If you have Paywall access,

simply login first to see your comment auto-approved.

Note on comments privacy & moderation

Your email is never published nor shared.

Comments are moderated. If you don't see your comment, please be patient. If approved, it will appear here soon. Do not post your comment a second time.

Paywall Access

Lost your password?Edit your comment