Black People’s Problems are Your Fault

Posted By Beau Albrecht On In North American New Right | Comments DisabledOnce again, a deluge of digital detritus washed in on my MS Edge start page. This cybernetic flotsam always gives me such hope for the future of humanity that it warms my flinty little heart. As usual, I just can’t help sharing. Here I’ll give special recognition to blacks, the race that has done so much to make the United States the wonderful place it is today.

Blacks got their fingers burnt in cryptocurrency, but it’s someone else’s fault

The Clinton News Network came out with an article with the heady title of “Opinion: Crypto was billed as a vehicle to wealth. For many Black investors, it’s been anything but [2].” According to the author’s biographical blurb, “Tonantzin Carmona is a David M. Rubenstein fellow at the Brookings Institution. Her most recent work has focused on the risks and drawbacks of cryptocurrencies, particularly their impact on Black and Latinx communities.” Cool deal — an expert!

Anyway, before we go further, this fiasco of Afro-finance reminds me of a brief story in The Adventures of Huckleberry Finn, as described by Jim to Huck in Old Ebonics. I’m including it here because I’m a complete monster:

You know that one-laigged nigger dat b’longs to old Misto Bradish? Well, he sot up a bank, en say anybody dat put in a dollar would git fo’ dollars mo’ at de en’ er de year. Well, all de niggers went in, but dey didn’t have much. I wuz de on’y one dat had much. So I stuck out for mo’ dan fo’ dollars, en I said ‘f I didn’ git it I’d start a bank mysef. Well, o’ course dat nigger want’ to keep me out er de business, bekase he says dey warn’t business ‘nough for two banks, so he say I could put in my five dollars en he pay me thirty-five at de en’ er de year.

So I done it. Den I reck’n’d I’d inves’ de thirty-five dollars right off en keep things a-movin’. Dey wuz a nigger name’ Bob, dat had ketched a wood-flat, en his marster didn’ know it; en I bought it off’n him en told him to take de thirty-five dollars when de en’ er de year come; but somebody stole de wood-flat dat night, en nex day de one-laigged nigger say de bank’s busted. So dey didn’ none uv us git no money.

The CNN article begins describing the potential that cryptocurrency had, according to some high-profile endorsements:

Just a few short months ago, venture capital firms [3], celebrities [4] and even some elected officials [5] were hailing cryptocurrency as the future of personal finance, an investment vehicle that could turn modest nest eggs into massive fortunes.

I say that if anyone else deserves blame, it would be these very figures for getting the hopes up of inexperienced investors without properly explaining the risks. Have they no shame? For one thing, owning stocks is like owning little pieces of corporations, but owning cryptocurrency is like owning a handful of magic fairy dust. (Fiat currency is like that, too, but it is a matter of degree.) Relying too much on endorsements by these celebrities and other trusted figures is what sent the star-struck down the garden path to losing their money.

Personally, I’ll give it a qualified “maybe” that Bitcoin is possibly better as an investment than a trip to the Vegas Strip, but that depends on the hardware in question. For example, I had a decent run on a Dolly Parton slot machine a few years ago. She’s a beautiful and honest lady with huge charisma, her talents so bountiful that words can hardly describe — such a pure vessel of womanly goodness — and she certainly wouldn’t dream of doing me wrong. I sure as heck trust Dolly Parton (and even any slot machine bearing her image) more than I trust Bitcoin.

The article takes things in a different direction, of course. Instead:

Among the advantages touted by its supporters was the claim [6] that crypto had the potential to close a pernicious, generations-old racial wealth gap for Black and Latino would-be investors. Cryptocurrencies, the narrative went, were primed to “democratize finance.”

[7]

[7]You can buy Beau Albrecht’s Space Vixen Trek here [8].

Now, that was a curious turn of phrase. Democracy is a type of representative government. Invoking it will tend to push the warm and fuzzy buttons in readers, invoking images of fairness. What could democratizing finance mean, then? Apparently it’s to do with closing the racial wealth gap, though it’s phrased in tricky language that is supposed to make the readers draw certain conclusions. Interestingly, there’s another type of government that considers absolute equality of wealth not just to be desirable, but as an imperative end goal. It’s called Communism.

As it happens, cryptocurrency didn’t end up closing the racial wealth gap, any more than did trillions in federal tax dollars since Lyndon Johnson. (Shocker that. . .) This is despite higher rates of minority involvement in cryptocurrency.

Black Americans have been among the groups hardest hit by crypto’s implosion because of their greater financial exposure and their later entry into the cryptocurrency market.

Then it says blacks tended to be late adopters. Moreover:

Research has shown that Black Americans are far less likely than their White counterparts to be invested in stocks — crypto appeared to offer an attractive alternative. But that lack of assets in traditional financial instruments, and in many instances, an absence of generational wealth, has made this group of investors particularly vulnerable to the precipitous swings in value with crypto.

Let me translate what we have so far. Blacks didn’t buy into cryptocurrency at the bottom. Instead, they started jumping into the market when prices were rising wildly. They assumed their investments would continue to increase in value. They didn’t anticipate that it could be nearing the top of a speculative bubble. They overlooked safer investments and didn’t diversify. All these are classic newb investor mistakes. The article simply could’ve explained the necessity of doing the research, or getting a decent financial advisor to avoid these pitfalls, and left out all the racial agitation.

Speculative bubbles, whether from overheated expectations or from outright scams, are not specific to any population. The infamous Dutch Tulipmania [9] comes to mind, for one thing. More recently, the Albanians suffered a major financial headache from a Ponzi scheme. Earlier, of course, there was the original Carlo Ponzi himself. Although Jews are pretty good with business, plenty of them got taken in by Bernie Madoff. Then there were the famous big Wall Street dips that hit everyone — like the 1987 oopsie, the dot-com bust, the Enron/Worldcom fiasco, and so on. As for the blacks who lost their shirts on dodgy cryptocurrency with wild swings in price and no intrinsic worth, was it just more of the same?

Since the story quite pointedly pushes a racial angle, this needs an answer. It argues persuasively that blacks got burnt disproportionately in cryptocurrency. This may well be so, and I won’t dispute it. I do have an alternate explanation, however. Notable black tendencies toward overconfidence (basically the Dunning-Kruger Effect [10]) didn’t help, and likewise their widespread belief, instilled by decades of Leftist propaganda and coddling, that they’re entitled to something for nothing. Hubris is a bitch with fleas. Wall Street has a fairly self-explanatory proverb: “Bulls make money, bears make money, but pigs get slaughtered.” Another way of putting it is that “a fool and his money are soon parted.”

The article finishes by dishing out plenty of blame, vaguely at society as a whole. Absent in the discussion are greedy blacks who caught gold fever, didn’t do the research on a very risky investment, bought in near the top, bet more than they could afford to lose, and then got their fingers burnt when the speculative bubble burst. Instead, it suggests their losses in cryptocurrency are part of a pattern of “predatory inclusion.” For one example:

And homeownership was made more accessible via subprime mortgages heralded as “innovations,” which decimated Black and Latino wealth during the 2008 financial crisis and its aftermath.

There’s more to it than that. To make a long story [11] short, the real deal is that the government started forcing banks to write mortgages for more minorities, despite the fact that they’re greater credit risks. We can’t let reality interfere with the wonderful fairy tale [12] that there are no racial differences [13] in intelligence or behavior that might affect personal financial outcomes, now can we? What’s the worst thing that possibly could happen from ignoring reality?

The article pointedly calls out the financial crisis for decimating the wealth of minorities. Oh, like it was easy on the rest of us? Everyone else was suffering during the 2008 meltdown too, thanks to a confluence of improvident debtors who welched on mortgages they never should’ve been offered, and government “anti-racist” meddling that practically mandated this. It wasn’t just the precious minorities whose wealth got strip-mined in that mess.

The exception to the suffering was a handful of gigantic corporations that came to the gummint begging. Other than two auto manufacturers, all were “too big to fail” banksters and financial institutions — in many cases ones that helped screw the economy. Those guys got massive TARP bailouts, were rewarded splendidly for failure, courtesy of the taxpayers who had been looted in the financial crisis. Ah, America!

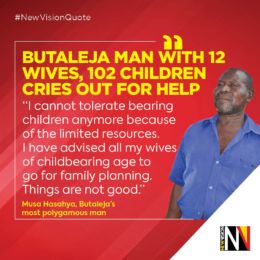

The Magic Meat Missile of Uganda

I’ve got to hand it to Uganda: Those folks really have their moments. If something funny and quirky happens in Africa, there’s a decent chance it was those Ugandans at it again. One of their citizens, Musa Hasahya, has a particularly prolific private part. Documenting the situation is a Daily Mail feature which is pretty much what it says on the tin: “102 children, 12 wives and 568 grandchildren: Ugandan farmer finally decides to stop adding to his family because his ‘income has become lower with the rising cost of living’ [14].”

The article’s two pictures alone are a trip. First you see part of his spawn in front of their huts, a somber crowd with nearly four dozen grim faces. In the next picture, the paterfamilias has a huge smirk as if he had just sowed his oats once again. At the very least, these heartwarming images will give you something to think about the next time some Leftist blames African poverty on the legacy of colonialism.

There’s a lot of strangeness to unpack already. For one thing, if he’s a farmer, then how can he do much farming if he’s seldom out of bed? Also, since the Magic Meat Missile is responsible for the existence of 670 piccaninnies through two generations, how does he keep track of all their names and birthdays? Whatever the case may be, the rising grocery budget has convinced him to use birth control at last. Better late than never, I suppose? I must say, if owning a farm doesn’t produce enough food for the consumption of the horde he founded, they indeed have a problem. According to the State Department [15], Uganda gets nearly a billion dollars in American foreign aid annually; I’m a bit curious as to how much of that is consumed by the supersized family of the Copulating Bull Without Equal.

He said: ‘My income has become lower and lower over the years due to the rising cost of living and my family has become bigger and bigger.

‘I married one woman after another. How can a man be satisfied with one woman,’ according to The Sun.

I don’t know how bad price increases are in Uganda, but inflation is a bitch here, too. (Let’s go Brandon!) A cart of groceries usually runs me $200 lately. At least I’m not responsible for the upkeep of multitudes of piccaninnies. Well, come to think of it, I am — taxes and all that [16]. It’s the same way in America: we produce; they reproduce.

As a Mormon, I can’t deny we had a troubled history with polygamy back in the early days. (There are some small splinter groups that still do, including one that’s imploding from genetic deterioration.) Looking back on the deadly aftermath from all that nineteenth-century grabass, it was pretty much a train wreck and not worth the extra hanky-panky. Live and learn, right? Now we have to wear magic underwear as a token of penance for this failed social experiment. Or something like that.

With all that in mind, I was a bit surprised to find that the fastest pecker in Uganda has figured out how to handle all the jealousy and drama that polygamy is so notorious for producing:

He said that all his wives live in the same house so that he can ‘monitor’ them, stopping them from eloping with other men.

I suppose that takes care of his part of the jealousy problem, but it’s uncertain how his dozen wives feel about that particular matter. Obviously it’s been working for him. He’s 67 years old, and since his first child is 51, the Magic Meat Missile has been bombing its biological warheads deep into grassy crevasses for a very long time.

On a side note, by any chance do you know a talented career woman with an advanced degree who dedicated her considerable skills toward consumerism, and is still single at 38 but just now is starting to catch baby rabies after pressing “snooze” on her biological clock for two decades? If so, the contrast here between Third World and First World reproduction patterns is a good illustration of what r/K selection theory [17] is about.

[18]

[18]You can buy J. A. Nicholl’s short story collection Venus and Her Thugs here [19].

This brings us to another problem. According to Richard Lynn’s world intelligence data [20], Uganda has an average IQ of 84. That’s actually pretty good for sub-Saharan Africa. For example, Somalia scores at 68, just at the threshold of the “special” range. (Since that’s an average, that means half of the fuzzy-wuzzies are even dumber.) At the bottom of the list is Equatorial Guinea, which boasts an average IQ of 59, and I suppose that’s before the jungle bunnies start huffing gasoline. How it’s possible that a society of literal morons can maintain itself is beyond my imagination. Nonetheless, although Uganda is somewhat better off, an average IQ of 84 is still nothing to brag about. Who the hell gave them permission to reproduce?

It’s unknown which side of Uganda’s intelligence bell curve that Mr. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. and Mrs. Hasahya are on. But it kind of speaks volumes that it took over a hundred piccaninnies between them to figure out that having more kids than you can afford is economically unviable. Since Uganda’s baby batter blaster and his harem of a dozen wives don’t seem to be the brightest bulbs in the chandelier, will their descendants (who increased over fivefold in the second generation, and counting) eventually inflict as much sheer incompetence on the world as the Chernobyl reactor explosion ejected radioactive fallout into the environment? I’m guessing they’re not all future doctors, industrialists, and rocket scientists. Then what happens if the grandchildren, great-grandchildren, and so forth keep breeding like bunny rabbits? This could end very badly; to invert the usual saying, a case of history repeating itself first as farce, and then as tragedy.

We’ve all seen the tear-jerker advertisements for the usual foundations and Non-Governmental Organizations, featuring starving kids who are often sick, sometimes covered in flies, and perhaps being stared down by a buzzard. How did things get to be so hopeless? Unless there was an unexpected event, like a massive crop failure or a war, then chances are it was the Malthusian end result of irresponsible runaway reproduction. At that point, providing aid would only continue enabling the “we feed, they breed” dynamic and produce more future misery. Come what may, these are the very people Madison Grant [21] and Lothrop Stoddard [22] tried to warn us about.

Maybe it’s really because some of you are downright annoying?

Last month, Essence put out an article called “What Is It About Black Women’s Power That Some White Men Find So Offensive? [23]” (How sassy — isn’t that cute? D’awwww!) The author is Ebony Flake, who should be nominated for an award about truthful names. This one begins:

Howard Stern is “uncomfortable” with how Oprah Winfrey “flaunts” her fortune. On his radio show [24], the notorious shock jock commented, “Oprah’s not embarrassed by her wealth at all.” She “loves showing it off” on social media.

Interesting, that. An evocative question comes to mind: What is it about Jewish men’s opinions that some black women find so offensive? More seriously, in conflicts between blacks and Jews, I usually find myself leaning vaguely in favor of our wayward Hebrew buddies. Still, I know that it’s best not to get involved when their golems inevitably chafe at the bit [25] and start getting rebellious [26].

The crabby commentary lists other individuals as targets of criticism, like Ketanji Brown Jackson and Michelle Obama. (In the latter case, I’d say that describing Michelle Obama as a woman is a case of assuming gender perhaps a bit too hastily.) But the major assertion is that white guys are intimidated by wealthy black women because we consider that as an inversion of the social order:

The advances of powerful Black women, who have historically existed at the bottom rung of the social ladder, are an affront to the deepest sensibilities of the white male power structure. “Historically, white men have held all the social, judicial, institutional, and economic power in our society. Black women were at one time literally treated as property in the name of profit,” Mckensie said.

This quotation was by “a research and change management expert in the organizational justice space and the chief purpose officer at change management firm MMG Earth.” I have no idea, either.

What to make of this? I don’t burn too many mental CPU cycles thinking about Oprah Winfrey. What I do know is that she’s a celebrity who started in acting and became a perennial TV talk show figure. It’s not quite my sort of thing, but she has millions of fans who feel otherwise. She got rich from showbiz; there are certainly worse ways to make money, so I’m not going to quibble about it. (After writing about blacks who catastrophically fail to manage their finances, it’s pretty refreshing to see one who has her act together and even made a fortune.) Although apparently she rubs Howard Stern the wrong way, I have no opinion about their personal spat.

Really, there are some nice black women out there. I have nothing but the best regards for black church ladies. They have character, class, and decency. Unfortunately, there are some other daughters of Africa who ruin it for their racial average. Leftist theory regards black women as a downtrodden category, possessing two intersectionality points right out the gate. (This is before any personal characteristics might add more points, such as sexual peculiarities, ambiguous mental conditions [27], a green tentacle growing out of her forehead, or habitual nose-picking.) In the real world, when these downtrodden black ladies are given jobs in which they’re granted even a little bit of power, many of them have a way of becoming remarkably overbearing. As low-level government bureaucrats, for example, they can be notoriously — shall we say — difficult.

In such situations, I’m generally inclined to grin and bear it, charitably assuming that I might be dealing with someone under a lot of stress. (I get it: Work sucks, film at 11.) Sometimes a little kindness can go a long way. On the other hand, I have my limits. If someone makes it personal, that’s intolerable. This is the phenomenon I find to be irritating, not the occasional self-made black female celebrity.

Much worse than overbearing bureaucrats, of course, are dweebs who write snippy articles with titles like “What Is It About Black Women’s Power That Some White Men Find So Offensive?” If they think that white guys are so difficult, the best solution is to leave us. Let’s all face it: Diversity is for the birds! In fact, they can repatriate themselves to Africa and enjoy feminist empowerment in the Dark Continent. Perhaps there’s a dope in Uganda who’d even take a mouthy journalist for a thirteenth wife.

* * *

Counter-Currents has extended special privileges to those who donate $120 or more per year.

- First, donor comments will appear immediately instead of waiting in a moderation queue. (People who abuse this privilege will lose it.)

- Second, donors will have immediate access to all Counter-Currents posts. Non-donors will find that one post a day, five posts a week will be behind a “Paywall” and will be available to the general public after 30 days.

- Third, Paywall members have the ability to edit their comments.

- Fourth, Paywall members can “commission” a yearly article from Counter-Currents. Just send a question that you’d like to have discussed to [email protected] [28]. (Obviously, the topics must be suitable to Counter-Currents and its broader project, as well as the interests and expertise of our writers.)

To get full access to all content behind the paywall, sign up here:

Paywall Gift Subscriptions

[29]If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

[29]If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

- your payment

- the recipient’s name

- the recipient’s email address

- your name

- your email address

To register, just fill out this form and we will walk you through the payment and registration process. There are a number of different payment options.