The State of Bitcoin & the Crypto Industry

Posted By Karl Thorburn On In North American New Right | Comments DisabledThe last year has seen the price of a Bitcoin (BTC) crash from $69,000 to just under $16,000, a decline of approximately 77%. This is par for the course with Bitcoin, which usually has enormous 80-90% crashes every four years, with a number of smaller, 25-50% crashes occurring in between.

But as with each cycle, there are distinguishing features that set them apart. In this case, Bitcoin has matured into an asset that now has very liquid futures markets, as well as much wider mainstream adoption. In any gold-rush industry, there are people who use the rampant speculation to make a quick fortune and then exit stage left. This is “crypto” and “defi” (decentralized finance) — the Potemkin villages that seek to confuse and excite wide-eyed speculators. They attempt to replicate the appearance of genuine innovation that Bitcoin offers while remaining functionally centralized. Even worse, they offer no real benefit to users beyond speculation.

I’m fully aware that many people reading this will be thinking, “But isn’t Bitcoin also mere speculation? What does it offer users beyond the hope of future riches?” And for that I would direct readers to this piece on the subject [2]. (The purpose of my piece is not to make a fundamental case for Bitcoin, but rather simply to explain the recent happenings involving the collapse of two large crypto exchanges, and what we can expect going forward.)

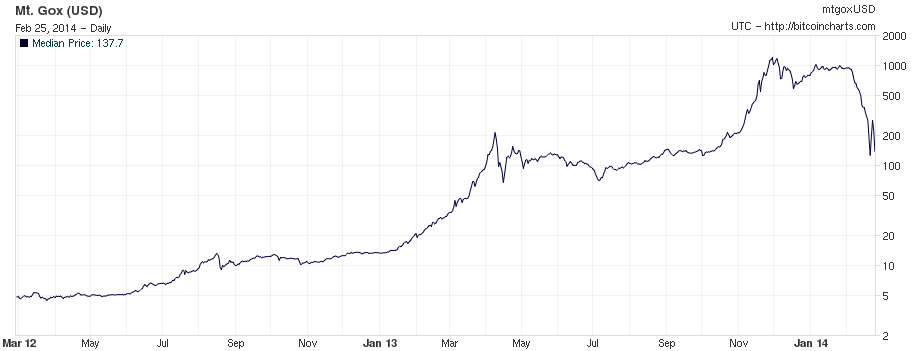

People who have paid attention to Bitcoin for a long time will know about an early exchange that was called MtGox (short for “Magic: The Gathering online exchange”). Originally, this site was for players of the collectible card game to meet and buy or sell their rare cards. When the owners of the site became aware of the nascent Internet currency Bitcoin, they saw an opportunity to create a large market for traders. The fellow in charge of MtGox was Mark Karpeles, a French-Jewish man living in Japan. The exchange had an effective monopoly on Bitcoin trading for a while and helped elevate the price from a few dollars up to more than $1,200 at its peak. They did this with the aid of some manipulation: a bot that would automatically buy Bitcoin at opportune moments, which created fake demand that traders interpreted as heavy interest at key support levels in the chart. This is what drove the first Bitcoin hype cycle and ultimately resulted in a 90% crash after the peak in winter 2013.

This “demand spoofing” coincided with MtGox being (supposedly) hacked and losing 850,000 BTC, of which about 200,000 were recovered. Thus, early users of this exchange who kept their coins in MtGox’s custody are still waiting to receive a fraction of what they had, and the Japanese trustee is dragging his feet in returning the coins. This was the first big lesson in the dangers of trusting a third party with Bitcoins — and it should have been enough, but most people don’t learn from observing others’ mistakes.

The more recent exchange collapses occurred in a much more mature and large market, spreading across many different cryptocurrencies. In the case of Celsius, its CEO, Alex Machinsky, was a 1982 graduate of the Open University of Israel who later attended Tel Aviv University and majored in Economics. Apparently they teach financial alchemy in Israeli universities, because after starting Celsius he began offering high-yielding accounts at a time when interest rates were very low. This in itself is suspicious and should have set off alarm bells. How was Machinsky guaranteeing returns well above the rate of interest? By definition, that requires excessive risk-taking. To make matters worse, Celsius wanted customers to deposit relatively new and illiquid altcoins and stablecoins. This whole charade would have been somewhat more believable if customers could deposit regular dollars and get a dollar yield. Involving crypto implies that the financial magic trick only works when demand for these altcoins is high.

[4]

[4]You can buy Greg Johnson’s The White Nationalist Manifesto here [5]

Newbie traders who were mostly financially illiterate fell for the trap, however. It didn’t help that YouTube mini-celebrities were also pushing these products and trades. There is an unfortunate romanticization of the trader profession, particularly on social media. As much as I appreciate the importance of the market system of price discovery, I also find full-time trading to be a sleazy thing to aspire to. One should hope to contribute to the world in a more personal and meaningful way. Every one of these exchanges play on the same dopamine triggers that casinos do. This is why in my first article for Counter-Currents [6] I made the case that people not even attempt to trade. Trying to time the market almost never works, and only leads to more stress than a simple gradual accumulation strategy. I also warned against altcoins. In finance, the devil is often in complexity, so a simple Bitcoin-only strategy is what I use and I recommend for most others.

Another recent collapse was the Terra Luna stablecoin. A stablecoin is a cryptocurrency that’s meant to be pegged to the value of a government currency, in this case the dollar. The creator of this currency was Do Kwon, a young Korean man who tricked people into believing he could maintain a value-peg without having full backing. Normally, a third party would promise to exchange a token for the underlying asset, necessitating the storage of the asset itself. Instead, Do Kwon would use some kind of automated trading algorithm (sound familiar?) to artificially maintain a dollar peg while transferring risk away from the stablecoin and into the Luna token. To fully understand the inner workings of this system would require “Slippin’ Jimmy” levels of scamming experience. But again, it comes back to a fatal flaw that some skepticism and common sense would have noticed: It’s simply not possible to mint a new token and then decree that token is worth the same as some other asset, particularly when you don’t have that asset in your vault. I don’t care how complex your trading algorithm is. Even governments can’t do this (such as in 1971, when Nixon unpegged the US dollar from gold because he knew there wasn’t enough gold in the vaults). Anytime someone says something is “pegged” to the value of another thing, you should be skeptical.

The Terra Luna and Celsius collapses occurred after Bitcoin’s first peak in April 2021 at $64,000. Then after crashing below $30,000 that summer, another bull run commenced, bringing Bitcoin to its all-time high of $69,000 in November 2021. The precise causes of these bubbles and crashes are complex and varied. I liken it to trying to guess where a piece on an Ouija board will land next, because everybody is trying to move it in different directions, and there are many people who profit on both sides of the trade. Price manipulation occurs in both directions. But traders view Bitcoin as part of this larger crypto industry, and a lot of the collateral used to leverage altcoin trades happens to be Bitcoin. This means that when altcoins and Ponzi exchanges flounder, Bitcoin suffers some of that selling pressure. Notice that this is not a fundamental link between Bitcoin and crypto, but one imposed on it by the impressions of low-information traders.

The most recent crypto firm to go under was FTX, a large exchange founded by Sam Bankman-Fried, a young American Jew who graduated from MIT. Sam’s parents both worked in the tax compliance field, which gave investors some sense that he was trustworthy. The mainstream media fawned over Bankman-Fried, writing gushing pieces and producing videos about him in which he was shown to be a wild-haired slob who wears cargo shorts and cheap t-shirts. In the videos, he bragged about how frugal he is despite being a billionaire, and says he wants to give all his money away to make the world a better place. He managed to give $37 million to Democrats in the last election cycle alone, and made the maximum donation to Nancy Pelosi’s likely successor, Rep. Hakeem Jeffries (D-N.Y.). This placed Bankman-Fried just behind George Soros as the largest individual contributor to Democrat causes, and it is almost certain his long-term goal was to take over where George Soros leaves off. This is why I believe the Right is fortunate that FTX collapsed. If it had continued to grow, Bankman-Fried’s fortune would have likewise continued to balloon.

The collapse itself was similar in many ways to the Bernie Madoff scam, where the firm was investing depositors’ money in risky bets without their knowledge or consent. FTX created its own cryptocurrency called FTT, and this token had no real reason to exist beyond providing a few small perks to FTX traders. People started to notice that the token would occasionally fall to $22 and then bounce along that level for a while before recovering. This would become important later when the CEO of FTX, a 28-year-old woman named Caroline Ellison, announced on Twitter that she would happily buy up another exchange’s FTT tokens for $22 each. This essentially confirmed to traders that $22 was a key price level that FTX was defending to the death. Caroline’s announcement was stupidity squared. The first mistake was making FTX’s balance sheet so heavily reliant on the value of a worthless “utility token” like FTT. The second was publicly giving away the price level at which FTX would scream “Uncle!” Naturally, the market reacted by dumping FTT, taking the price from $22 to just $1 and rendering FTX insolvent in the process.

Because FTX was leveraged to the hilt, and the assets side of their balance sheet had just struck an iceberg, Bankman-Fried was forced to get on Twitter and announce that they would be halting all withdrawals and that they are officially insolvent. This sent all cryptocurrencies crashing even more — on top of the existing crash that had been unfolding over the last year. Today we are finding out that Sam Bankman-Fried, Caroline Ellison, and around eight other people were living together in a single house in some kind of polyamorous open relationship, and there are even threats being made by anonymous accounts to leak pictures of the scandalous sexcapades that these financial wizards were having in the Bahamas. As Trump would say, “They’re not sending their best.”

So where does this leave us today? Currently, Bitcoin has been beaten down to such an extent that it is underpriced by even the most conservative metrics. Rapidly rising interest rates, as well as a rising dollar index, have conspired to push the prices of all risk assets even lower. We also have the threat of an impending deep recession and a housing market crash. The question is: How much of this fear and uncertainty has the market already factored into the price? There’s no way of knowing for certain, but we can see on the blockchain that the number of BTC that have not moved in over a year has risen to a new all-time high of 67%. Historically speaking, when that figure hits a new high it is followed by a long bull run. And it would make sense that Bitcoin recovers at least somewhat over the next year, given how terrible the last year has been. At some point the marginal sell pressure will become exhausted, and we will see a short squeeze.

This reveals Bitcoin’s hidden base of demand, which is constantly growing. This base of demand is the key, but it’s impossible to see except during periods of extreme market fear. Just two years ago Bitcoin traded at under $4,000, and now we are just under $17,000, so the trend is still Bitcoin’s friend. Let the bears have their fun. Meanwhile, I am accumulating!

* * *

Counter-Currents has extended special privileges to those who donate $120 or more per year.

- First, donor comments will appear immediately instead of waiting in a moderation queue. (People who abuse this privilege will lose it.)

- Second, donors will have immediate access to all Counter-Currents posts. Non-donors will find that one post a day, five posts a week will be behind a “Paywall” and will be available to the general public after 30 days.

- Third, Paywall members have the ability to edit their comments.

- Fourth, Paywall members can “commission” a yearly article from Counter-Currents. Just send a question that you’d like to have discussed to [email protected] [8]. (Obviously, the topics must be suitable to Counter-Currents and its broader project, as well as the interests and expertise of our writers.)

- Fifth, Paywall members will have access to the Counter-Currents Telegram group.

To get full access to all content behind the paywall, sign up here:

Paywall Gift Subscriptions

[9]If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

[9]If you are already behind the paywall and want to share the benefits, Counter-Currents also offers paywall gift subscriptions. We need just five things from you:

- your payment

- the recipient’s name

- the recipient’s email address

- your name

- your email address

To register, just fill out this form and we will walk you through the payment and registration process. There are a number of different payment options.